Top FP&A Analyst Responsibilities You Should Know in 2025

Introduction to FP&A Analyst Responsibilities

FP&A is a vital function for businesses of all sizes in India. However, the scope of work differs from company to company, depending on size & industry. The smaller the company, more generalized the function is ie. you get to involve yourself more closely with business decisions in multiple departments.

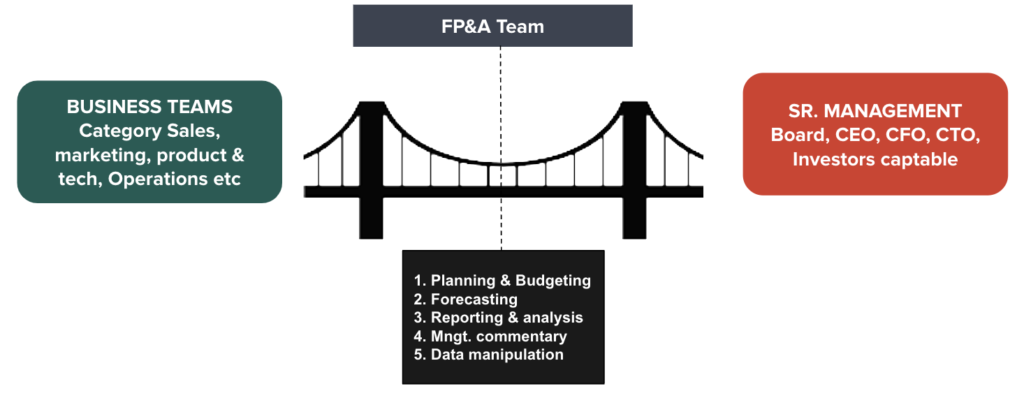

The role of individuals in FP&A extends well beyond basic budgeting, forecasting, and planning. As the central link between various teams, FP&A professionals are pivotal in business operations. Every business decision has a financial aspect that requires validation and approval by the Business Finance or FP&A teams, ensuring that all actions align with the company’s financial strategies and goals.

Also Read: What is Internal Audit? Why does it matter?

Some of the key FP&A Analyst Responsibilities include:

● Preparing financial reports & budgets,

● Analyzing financial and operational data to gather insights,

● Developing financial forecasts & plans,

● Providing financial advice to management & approving all major expenses (POs),

● Supporting business decision-making through prudent financial planning,

● Managing financial & business risks through stress testing all numbers.

For instance: A senior FP&A manager work responsibility may include chairing the company’s capital expenditure approval committee. In plain language, the monthly/weekly session where you will review all capex proposals > INR 50k for approval.

Now, for each capital project you have to wear 5 different hats:

- Leader – Judgment on alignment of project to strategy, and review their financial case

- Driver – Ensuring resources in place to execute project and deliver the payback

- Operator – Ensuring the correct depreciation policy is applied by controllership/accounting teams

- Financier – Agreeing the plan for funding the project along with the rights & obligations.

- Custodian – Formal approval of the capex (and ensuring it can’t be released without approval)

Common Reports and Reviews Handled by FP&A Professionals:

1. Planning & Budgeting:

- Annual Operating Plan (AOP): Comprehensive yearly planning.

- Quarterly Plans: Detailed planning conducted every quarter.

- Budgets: Prepared monthly or quarterly to manage spending.

- Headcount Planning: Forecasting staffing needs.

- Long Range Strategic Planning: Long-term strategy development.

2. Reporting & Analysis:

- Operational Reporting: Monitoring day-to-day operations.

- Financial Reporting: Tracking financial health and compliance.

- KPIs: Key Performance Indicators to measure success.

- Dashboards: Visual displays of data and trends.

- Variance Analysis: Comparing expected outcomes to actual results.

- PVM Analysis: Price Volume Mix analysis to understand sales dynamics.

- Drill-through/Roll-up/Drill-across Reports: Techniques for exploring data details and summaries.

3. Forecasting:

- Rolling Forecasts: Updating forecasts regularly to reflect new data.

- Trend Analysis: Analyzing patterns in data over time.

- Predictive Analytics: Using statistics and modeling to predict future trends.

4. Financial Modeling:

- What-If Analysis: Exploring hypothetical scenarios.

- Scenario Analysis: Assessing potential future events and their impacts.

If you’re starting out your career, you will be actively preparing a lot of them, every week/month. If you’re already an experienced professional, you will be actively reviewing a lot of them, for final submissions.

And once you’re VP/CFO of the company (let’s just say, the top brass), you will be directly taking decisions on the basis of these reports & submissions. The numbers driving these models will directly impact the way companies pivot in their lifecycle.

Conclusion

Preparing for an FP&A interview requires not just knowledge and skills, but a strategic approach to showcasing your qualifications. Our Financial Planning & Analysis Masterclass is designed to provide you with comprehensive training that covers all aspects of FP&A, from fundamental concepts to advanced financial modeling techniques. This masterclass will help you build confidence and enhance your abilities to tackle even the most challenging interview questions effectively.

Ready to take your FP&A career to the next level? Enroll in our Financial Planning & Analysis Masterclass today and gain the edge you need to succeed in your next interview. Enroll Now