Why Financial Due Diligence is the Role for Freshers?

For many auditors, a common career question is what comes after mastering compliance and checklists. The desire for a role that leverages accounting skills to influence major business decisions often leads to exploring new fields. Financial Due Diligence (FDD) is one such path. FDD applies accounting expertise to high-stakes transactions, shifting the focus from compliance to value creation, where analysis can directly impact significant deals.

This article will explain what FDD entails, how it differs from statutory audit, and what a typical day in the role involves. We will also cover the career opportunities and salary potential associated with this field.

What is FDD financial due diligence?

In simple terms, FDD is an in-depth investigation into a company’s financial health before a transaction like a merger, acquisition, or major investment. The goal is to verify the seller’s claims and provide the buyer with a clear picture of the company’s financial standing.

While an audit confirms historical accuracy, FDD focuses on assessing the sustainability of earnings. It seeks to answer the question: “Is this company’s performance repeatable, or is it an anomaly?”

Each FDD project is tailored to the specific deal; it is not a standardized process. The scope extends beyond financial statements to include operations, market trends, and any risks that could affect the deal post-closure.

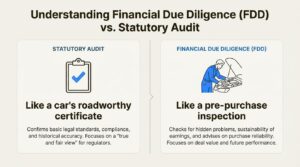

To use an analogy, a statutory audit is like a car’s roadworthy certificate, confirming it meets basic legal standards. FDD is comparable to a pre-purchase inspection by a mechanic. The mechanic delves deeper into the car’s history, checks for hidden engine problems, and advises on whether the car is a reliable purchase. FDD provides that same deep, practical insight for a business deal. The following graphic helps illustrate this distinction.

FDD vs. statutory audit: Key differences

While both FDD and audit require a strong accounting background, the mindset, goals, and day-to-day work are different. FDD combines elements of accounting, finance, and business strategy.

An audit provides assurance that historical financial statements are accurate and comply with regulations. FDD provides insights that directly affect how a deal is valued, negotiated, and structured. It involves looking at historical data to predict future performance.

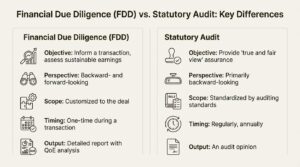

Key differences at a glance

The best way to see the contrast is to put them side-by-side.

| Feature | Financial Due Diligence (FDD) | Statutory Audit |

|---|---|---|

| Primary Objective | Inform a specific transaction; assess a company’s sustainable economic earnings, risks, and trends for a buyer or investor. | Provide assurance that financial statements give a ‘true and fair view’ and comply with accounting standards (e.g., IFRS, GAAP). |

| Perspective | Both backward- and forward-looking; analyzes historical data to assess the sustainability of future performance. | Primarily backward-looking; verifies historical financial statements and compliance with regulations. |

| Scope | Customized to the deal and buyer’s needs; focuses on key value drivers like Quality of Earnings, Net Working Capital, and Net Debt. | Standardized process dictated by auditing standards; focuses on material misstatements and statutory compliance. |

| Timing & Frequency | A one-time analysis performed specifically during a transaction. | Conducted regularly (annually or quarterly) as a legal requirement for many companies. |

| Output | A detailed report (often 25 pages or more) with a Quality of Earnings analysis, red flags, and recommendations for the Sale and Purchase Agreement (SPA). | An audit opinion, which is typically a much shorter document, stating whether financials are free from material misstatement. |

The importance of the mindset shift

The primary difference lies in the core objective. An audit career is built around compliance and managing risk. The job is to ensure rules were followed. FDD is focused on creating value. The job is to find insights that can impact a deal’s financial outcome.

In FDD, professionals must think like an owner and understand the story behind the numbers. For example, why did sales increase last quarter? Was it a one-time event or sustainable growth? Why are margins decreasing? Is it a pricing issue or rising supplier costs?

This analytical approach is a core part of the role. It involves more than following a checklist; it requires acting as a financial detective to piece together clues and build an investment case. The insights found have a direct impact on deal terms.

Curious about the difference in your region? Use our Salary Estimator to compare the starting salary of an FDD Analyst versus a Statutory Auditor.

A day in the life: Core FDD workstreams

An FDD professional’s work revolves around a few core analyses that directly affect the final purchase price and negotiations.

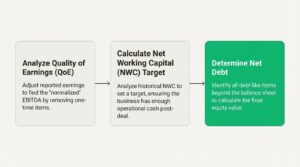

Analyzing the quality of earnings (QoE)

This is a central component of FDD. In many deals, the purchase price is calculated as a multiple of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). A Quality of Earnings report aims to determine a “sustainable” or “normalized” EBITDA that a buyer can rely on.

In practice, this involves adjusting the company’s reported earnings by removing any one-time or non-recurring items. Examples include:

- A large gain from selling a factory.

- A significant settlement from a lawsuit.

- Revenue from a single, large project that is not expected to recur.

- Personal owner expenses being run through the business.

By removing these items, you can identify the company’s true, repeatable earning power. This normalized EBITDA is a critical number, as it forms the foundation for the business’s valuation.

Calculating the net working capital (NWC) target

Net Working Capital is the cash a business needs for its day-to-day operations. For M&A purposes, the formula is: Current Assets (excluding cash) minus Current Liabilities (excluding debt).

This is important in a deal because the buyer needs to ensure there will be enough working capital in the business on day one to pay suppliers and employees without injecting extra cash. The FDD team analyzes historical NWC levels to establish a negotiated “NWC target” or “peg”.

Determining net debt

The final piece of the valuation puzzle is Net Debt. This helps determine the final amount of cash the seller receives. The formula is: Enterprise Value – Net Debt = Equity Value.

The FDD team identifies all interest-bearing liabilities and other “debt-like” items that the buyer will absorb, which may go beyond the debt listed on the balance sheet. This could include unrecorded pension liabilities, capital leases, or certain customer deposits. A thorough net debt analysis ensures the buyer is not surprised by unexpected costs after the deal.

How FDD can advance your career

The strategic, high-stakes, and commercially-focused nature of FDD work leads to dynamic career paths and higher compensation compared to typical audit roles.

Top-tier exit opportunities

The skills developed in FDD, such as financial modeling, commercial awareness, and deal execution, are in high demand. This opens doors to many sought-after roles in finance. While auditors often move into corporate accounting or internal audit, FDD professionals have a more strategic set of exit options:

- Corporate Development: Work in-house for a company, driving its M&A strategy and executing deals.

- Strategic Finance & FP&A: Take on forward-looking finance roles that help shape a business’s long-term growth and strategy.

- Investment Banking: Deal experience provides a natural transition into an IB role focused on the full M&A lifecycle.

- Private Equity / Venture Capital: FDD is a well-trodden path to the buy-side, particularly for roles in MM/LMM PE funds or private credit firms.

The FDD salary premium

FDD roles typically command a higher salary because the work directly impacts value. An auditor provides assurance, while an FDD professional can financially impact a single transaction by millions of dollars.

The difference is often clear from the beginning of a career. The pay bump for moving from audit to FDD is a frequent topic of discussion, with one user noting their salary progression:

The gap often widens at more senior levels. It is not uncommon for FDD managers and seniors to earn significantly more in total compensation than their audit counterparts.

From Compliance to Value Creation

For accounting professionals seeking a dynamic, challenging, and financially rewarding career path, FDD presents a compelling option. It is a field that places you at the center of major business transactions.

The fundamental difference between audit and FDD is the focus: FDD is about understanding the “why” behind the numbers to drive deal value, whereas audit focuses on verifying the “what” for compliance. This makes the role more of a strategic partner in a transaction.

For those whose analytical skills are well-suited to shaping business deals, financial due diligence is a career path worth considering.

Ready to see what your skills are worth in the world of transaction advisory? Check our Salary Estimator now and plan your next career move.

Also read: Investment Banking vs. Statutory Audit: Salary & Growth Reality Check

Frequently Asked Questions

Q.1 When is FDD performed outside of a transaction?

A: While it’s most common in M&A, a company might perform FDD on itself (called sell-side due diligence) to prepare for a sale, identify weaknesses, and get ahead of buyer questions. It’s also used for securing large financing rounds or partnerships.

Q.2 What is the biggest skill gap for an auditor transitioning to FDD?

A: The biggest shift is moving from a compliance mindset to a commercial one. You’ll need to develop your analytical skills to understand the “why” behind the numbers, not just verify their accuracy. Learning to think like an investor and assess future performance is key.

Q.3 How does FDD differ for a SaaS company versus a manufacturing company?

A: The focus changes dramatically. For a SaaS company, FDD dives deep into metrics like Annual Recurring Revenue (ARR), customer churn, and customer acquisition cost. For a manufacturing company, the focus might be more on inventory valuation, capital expenditures, and supply chain risks. The core principles are the same, but the application is industry-specific.

Q.4 How long does the FDD process typically take?

A: It varies depending on the deal’s complexity and the company’s size, but a typical FDD project can take anywhere from a few weeks to a couple of months. It’s an intense, fast-paced process tied directly to the M&A timeline.

Q.5 What is FDD’s role in the Sale and Purchase Agreement (SPA)?

A: The findings from FDD directly influence the SPA, which is the legal contract for the sale. Key analyses like the Quality of Earnings, Net Working Capital target, and Net Debt are used to set the final purchase price and include protections for the buyer.

Q.6 What is the first step for an auditor to transition to FDD?

A: Start by networking with professionals in your firm’s transaction advisory or FDD team. Express your interest, learn about their projects, and highlight your analytical skills. Many Big 4 firms have clear pathways for high-performing auditors to rotate into FDD.