Ind AS 116 Interview Questions: Big 4 Audit Prep Guide

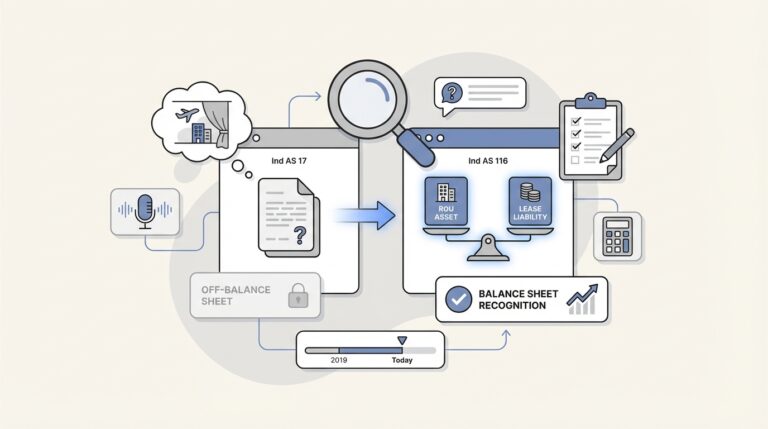

Picture this: it’s 2018, and a huge airline with a massive fleet of jets doesn’t actually own a single one. They’re all leased. Under the old accounting rules, these massive obligations were just footnotes in the financial statements, largely invisible on the balance sheet. This made it really hard for investors to see the company’s real financial commitments and compare it to a competitor that owned its planes.

The introduction of Ind AS 116 changed this. It brought almost all leases onto the balance sheet and transformed how companies report their assets and liabilities. This was a significant update that enhanced financial transparency. Before the new standard, the IFRS Foundation figured that listed companies had nearly US$3 trillion of off-balance-sheet lease commitments. This change brought previously hidden debt into view.

This is why interviewers frequently ask about it. It is an effective way to test a candidate’s business acumen. This guide focuses on practical, real-world questions commonly asked in audit and finance interviews.

Understanding Ind AS 116

In short, Ind AS 116 is the Indian accounting standard for leases. It became mandatory on April 1, 2019, and replaced the old standard, Ind AS 17. Its main goal is to make sure companies provide relevant information that faithfully represents lease transactions, which makes their financial reports more transparent and easier to compare.

The standard makes companies (lessees) recognize assets and liabilities for basically all their leases. The main exceptions are for leases that are 12 months or shorter, or for assets with a very low value, like a laptop or an office phone.

The most significant change was the elimination of the old distinction between ‘finance leases’ and ‘operating leases’ for the company leasing the asset. Under Ind AS 17, operating leases were treated as a simple rental expense and never showed up on the balance sheet. Ind AS 116 changed that by forcing companies to record a ‘right-of-use’ (ROU) asset and a matching lease liability on their balance sheet.

This had a huge business impact, especially for companies in industries like aviation, retail, and telecom that lease a lot of their assets. Their reported assets and liabilities jumped overnight. It also changed how expenses are recorded. Instead of a simple, straight-line rent expense, companies now book separate depreciation and interest expenses. This has a major effect on key metrics like EBITDA, which we’ll get into a bit later.

How these interview questions were selected

These questions have been selected to reflect what top firms are actually asking candidates in 2026. The selection criteria include:

- Frequency: These questions are frequently asked, based on the real interview experiences of candidates who landed jobs at the Big 4 and other top firms. First a bit about myself (classic question, you gotta prepare it well)

Then some study related questions, cash flows, external confirmation, as, sa, journal entries, auditing

Then at last some generic questions like why big four, why (city name), why correspondence over regular college

- Core Concepts: The questions address the fundamental aspects of the standard. If you can answer these well, you really understand Ind AS 116.

- Practical Application: The questions require thinking from the perspective of an auditor or financial controller, not just a student who memorized the rules.

- Business Acumen: They assess understanding of the standard’s purpose and its real-world business impact.

An overview of the interview questions

To help you focus your prep time, here’s a quick look at what each question is designed to test.

| Question Focus | Core Concept Tested | Level of Difficulty | Business Acumen Focus |

|---|---|---|---|

| Ind AS 17 vs. 116 | The fundamental shift in lease accounting | Intermediate | Understanding the “why” behind the standard |

| ROU Asset & Liability | Initial recognition and measurement mechanics | Intermediate | The core of practical implementation |

| Financial Statement Impact | Analysis of key metrics and ratios | Advanced | Connecting accounting entries to business performance |

| Exemptions | Practical judgment and application | Intermediate | Knowing the real-world exceptions to the rule |

| Lessee Disclosures | Reporting transparency and compliance | Advanced | Adopting an auditor’s mindset for compliance |

5 key Ind AS 116 interview questions

This section breaks down each question to help you structure a comprehensive answer.

1. What are the key differences between Ind AS 116 and the old standard, Ind AS 17?

What the interviewer is really asking:

This question assesses your understanding of the overall purpose of Ind AS 116 and the main problem it was created to solve. They want to see that you understand the “why,” not just the “what.”

How to structure your answer:

Start with the biggest difference: for lessees, Ind AS 116 brought in a single accounting model where everything goes on the balance sheet. It eliminated the distinction between operating and finance leases, which was the main feature of Ind AS 17.

Then, explain what this change actually means. Under Ind AS 116, almost every lease is capitalized on the balance sheet. This is a huge shift from Ind AS 17, where operating leases were kept off the books, making it hard to see a company’s real leasing commitments.

Next, talk about the impact. The new standard dramatically increased financial transparency and made it easier to compare companies that lease most of their assets (like an airline) with those that buy them.

Finally, add a bit of detail to show you know your stuff. Briefly mention that for lessors (the ones leasing out the asset), the accounting didn’t really change. They still classify leases as either finance or operating, just like they did before.

2. Walk me through how a lessee recognizes a right-of-use asset and a lease liability.

What the interviewer is really asking:

This question tests your technical knowledge and ability to apply the standard in a real situation.

How to structure your answer:

Explain that you always start with the Lease Liability. It’s measured at the present value of all future lease payments that haven’t been paid yet. Be sure to mention the key parts of these payments:

- Fixed payments (minus any lease incentives).

- Variable payments tied to an index or rate.

- Any amounts the company expects to pay under residual value guarantees.

- The exercise price of a purchase option, but only if it’s pretty certain the company will use it.

Next, move on to the Right-of-Use (ROU) Asset. Explain that its starting value is based directly on the lease liability you just calculated. The total cost of the ROU asset includes four main things:

- The initial amount of the lease liability.

- Any lease payments made before the lease officially starts, minus any incentives.

- Any initial direct costs incurred by the company to get the lease set up.

- An estimate of what it will cost to take apart, remove, or restore the asset at the end of the lease.

Don’t forget to mention the Discount Rate. This is super important. You should use the interest rate that’s implicit in the lease. If you can’t easily find that, which is often the case, the company uses its incremental borrowing rate. This is the rate it would have to pay to borrow funds to purchase a similar asset.

Prepare for interviews with our Interview Bot.

3. How does adopting Ind AS 116 affect a company’s key financial statements and ratios?

What the interviewer is really asking:

This tests your ability to think like a financial analyst and connect accounting entries to real-world business performance. This is an opportunity to demonstrate your business acumen.

How to structure your answer:

Break it down by each financial statement.

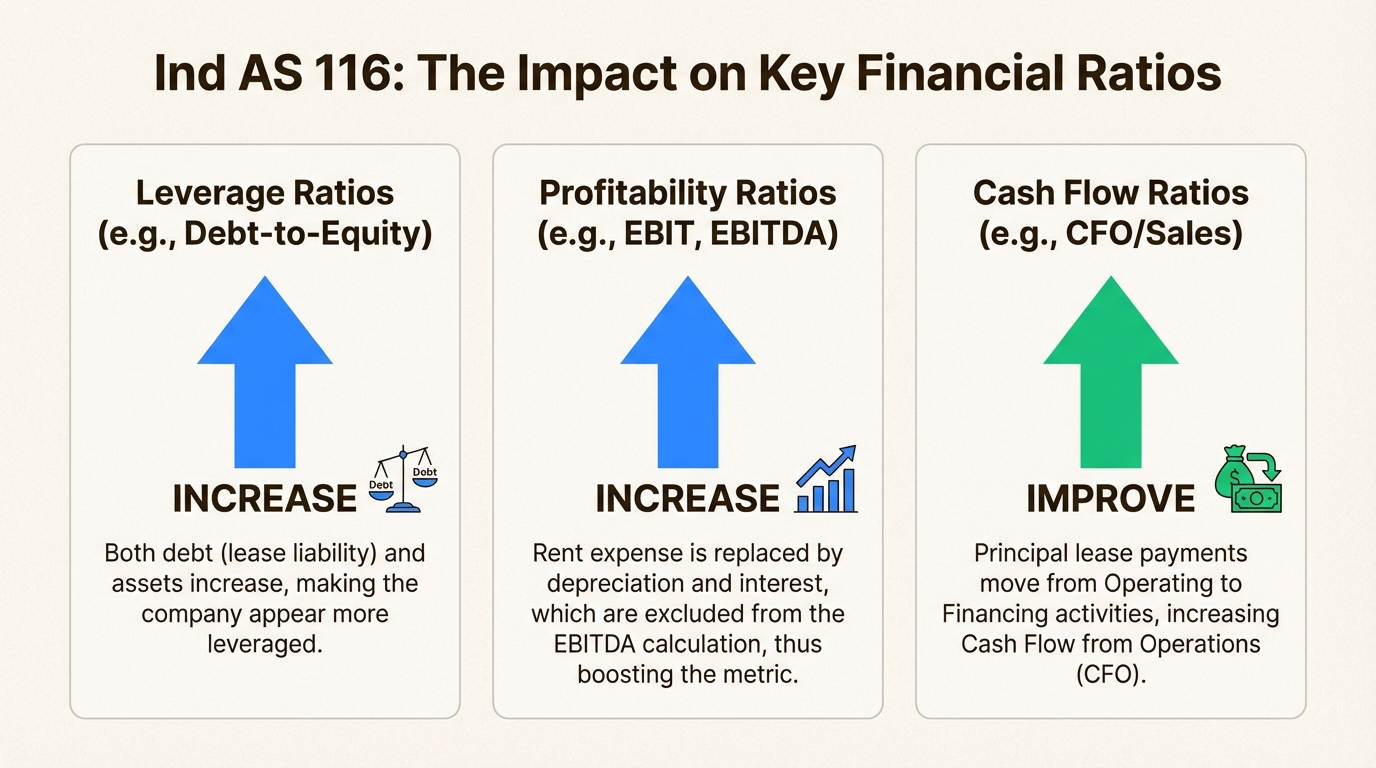

- Balance Sheet: Both assets (the ROU asset) and financial liabilities (the lease liability) go up a lot. This directly affects a company’s financial leverage, increasing ratios like Debt-to-Equity.

- Income Statement: Here, the nature of the expense changes. The old, predictable ‘rent expense’ is gone. Instead, the company now recognizes ‘depreciation expense’ on the ROU asset and ‘interest expense’ on the lease liability. This change front-loads the total expense, so it’s higher in the early years of the lease.

- Cash Flow Statement: The classification of cash payments also changes. Under Ind AS 17, all operating lease payments were just operating outflows. Now, under Ind AS 116, the principal part of the payment is a financing outflow. The interest part is also usually a financing activity, as guided by Ind AS 7, Statement of Cash Flows. This shift generally makes Cash Flow from Operations (CFO) look a lot better.

- Key Ratios: This is a key area to highlight. The big one is EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). It goes up because the old rent expense, which used to lower it, is now replaced by depreciation and interest, both of which are excluded from the EBITDA calculation. Use a clear example here. Talk about a retail chain with hundreds of leased stores and how their EBITDA would have jumped after adopting the standard, making them look more profitable by that one metric.

4. What are the practical expedients or recognition exemptions allowed under Ind AS 116?

What the interviewer is really asking:

This question tests your knowledge of the standard’s practical exceptions and your ability to apply good judgment in a real audit.

How to structure your answer:

Clearly state the two main exemptions a company can choose to use. It’s important to mention that these are optional.

- Short-term leases: These are leases with a term of 12 months or less that don’t have a purchase option. For these, a company can just recognize the lease payments as an expense on a straight-line basis over the lease term, just like in the old days.

- Leases of low-value assets: This applies to leases where the asset itself has a low value when it’s new. Think about things like tablets, PCs, or small office furniture. The key here is that this is based on the absolute value of the asset, not on whether it’s a big deal to the company. A laptop is a low-value asset whether you’re a small startup or a huge corporation.

Make sure to explain that these are policy choices. The exemption for short-term leases can be applied on a case-by-case basis, while the low-value asset exemption is usually applied to a whole class of assets.

5. From an auditor’s perspective, what are the main disclosure requirements for a lessee?

What the interviewer is really asking:

This question evaluates if you have an auditor’s mindset and know what needs to be in the notes to the financial statements to keep the company compliant and investors informed.

How to structure your answer:

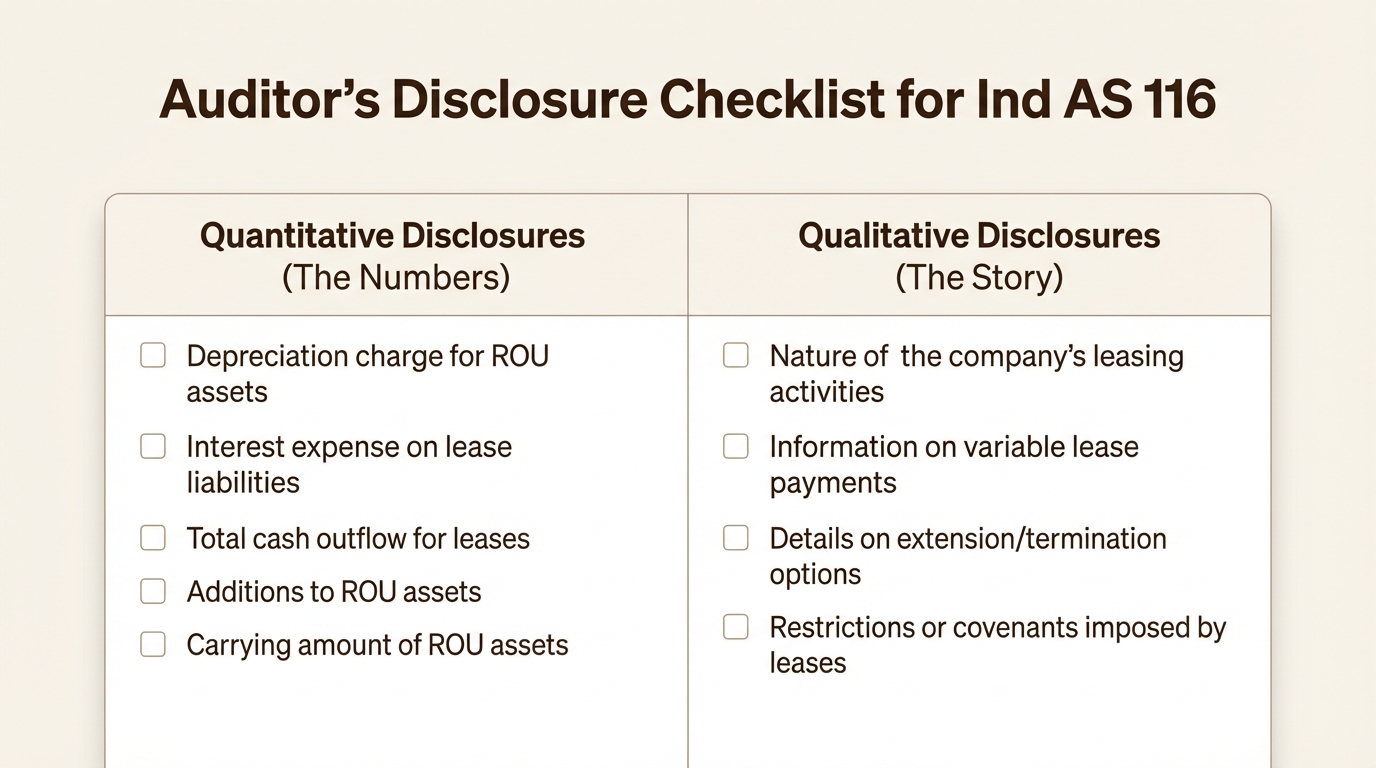

Start by explaining the main goal of the disclosures: to give people reading the financial statements enough information to understand the impact that leases have on the company’s financial position, performance, and cash flows.

Then, split your answer into two parts: quantitative and qualitative disclosures.

- Quantitative (The Numbers): You need to be specific here. According to the Ind AS 116 disclosure checklist, some of the key numbers a company must disclose include:

- The depreciation charge for ROU assets, usually broken down by the type of asset.

- The total interest expense on lease liabilities.

- The total cash paid for leases during the period.

- Any new ROU assets added.

- The carrying amount of ROU assets at the end of the year.

- The depreciation charge for ROU assets, usually broken down by the type of asset.

- Qualitative (The Story): It’s not just about the numbers. A company also needs to tell the story behind its leasing. This includes talking about the nature of its leases, giving information about any variable lease payments, discussing potential future cash outflows that aren’t in the liability yet (like from extension options), and mentioning any restrictions the lease agreements impose.

Tips for answering Ind AS 116 interview questions

Go beyond the standard. Don’t just sound like you’re reading from a textbook. Use phrases like, “The business impact of this is…” or “From an auditor’s point of view, the key risk here is…” This shows you get the commercial side of things.

Use industry examples. Have an example or two ready. Aviation, retail, and telecom are great choices because they were so heavily affected. Explaining how Ind AS 116 specifically affects them shows you’re commercially aware.

Discuss the implementation challenges. Show that you’ve thought about the practical side of putting the standard into practice. Mentioning challenges like gathering lease data, finding leases hidden in service contracts, or figuring out the right borrowing rate proves you’re thinking like a professional.

Highlight Ind AS 116 on your resume. Ind AS 116 is a sought-after skill, and recruiters’ systems are actively looking for it. Make sure it’s listed clearly in your skills section so your resume gets past the first filter.

Moving beyond theory

Mastering these questions isn’t about memorizing every single paragraph of the standard. It’s about really understanding the “why” behind it and being able to clearly explain its impact on a business.

This standard has had one of the biggest effects on financial reporting in the last decade, and interviewers know it. They use it to test both your technical knowledge and your business sense at the same time. By preparing for these five questions, you’re not just getting ready for an interview; you’re proving you have what it takes to think like a top-tier finance professional.

For those preparing for technical rounds, dedicated interview preparation programs can help turn a complex topic like Ind AS 116 into a strength.

Prepare for interviews with our Interview Bot.

Also read: Deloitte India vs. Deloitte USI: Salary, Shifts & Exit Options Compared

Frequently Asked Questions

Q.1 What is the most common mistake candidates make when answering Ind AS 116 interview questions?

A: A common slip-up is just reciting the standard without explaining the business impact. For example, saying “it increases assets and liabilities” is correct, but explaining *why* that matters for a company’s debt covenants or EBITDA calculation shows true business acumen.

Q.2 How can I use a real-world example to strengthen my answers to Ind AS 116 interview questions?

A: Pick an industry that relies heavily on leasing, like aviation or retail. You could talk about how an airline’s balance sheet would suddenly show billions in liabilities for its leased fleet, or how a retail chain’s profitability metrics like EBITDA would appear to improve simply because of the accounting change.

Q.3 Are there any tricky aspects of Ind AS 116 interview questions I should prepare for?

A: Yes. Interviewers might ask about lease modifications, sale-and-leaseback transactions, or how to determine the lease term when there are extension or termination options. These topics test your deeper, more practical understanding of the standard.

Q.4 Why do Big 4 firms focus so much on Ind AS 116 interview questions for audit roles?

A: Because it was a massive change that affects nearly every company. Auditors need to know the standard inside and out to assess risks, check for compliance, and understand its significant impact on a client’s financial statements and key performance indicators.

Q.5 Beyond the technical details, what are interviewers looking for in my responses to Ind AS 116 interview questions?

A: They’re testing your communication skills and commercial awareness. Can you explain a complex topic simply? Can you connect the accounting rules to how a business actually operates and how investors analyze it? They want to see that you can think like a business advisor, not just an accountant.

Q.6 How important is it to discuss the discount rate in Ind AS 116 interview questions?

A: It’s very important. Mentioning the discount rate (either the rate implicit in the lease or the incremental borrowing rate) shows you understand the practical mechanics of calculating the lease liability. It’s a detail that demonstrates you’ve gone beyond the high-level concepts.