Transfer Pricing Career Guide: Global Roles & Salaries

Ever find yourself scrolling through job postings in London, New York, or Dubai, dreaming of an international finance career? It’s a common dream, but for many accountants and finance pros, there’s a huge roadblock: local rules.

For professionals in statutory audit, expertise is often tied to specific standards. Moving from India to the UK isn’t just about packing your bags; it often means hitting the books all over again to learn a whole new framework. The same goes for domestic tax experts, as deep knowledge of one country’s tax code doesn’t always translate to another. This can make career mobility more complex.

But what if there was a specialization in finance that acted like a global passport? A field where the core principles are the same whether you’re in Singapore or San Francisco?

That’s where Transfer Pricing (TP) comes in. Because TP is built on a set of globally recognized standards, mainly the OECD Guidelines, the skills you build are incredibly portable. It’s a compelling niche for anyone who wants to see the world without having to start their career from scratch.

In this guide, we’ll break down everything you need to know about this career path. We’ll cover what the job is really like, what you can expect to earn, why it’s a great option for a global career, and how you can get your foot in the door.

What is transfer pricing?

So, what is transfer pricing? Simply put, it’s about setting the prices for transactions between related companies inside a big multinational corporation.

Think about a company like Tesla. As explained in the Transfer Pricing Career Guide, Tesla in Germany might sell batteries to Tesla in the US, which then assembles the cars. Those cars are then sold to Tesla in Norway for the final sale to customers. Every time a product, service, or even intellectual property (like a brand logo) crosses a border from one part of the company to another, a price has to be set for that internal “transfer.” That’s transfer pricing.

The goal is to make sure these internal prices are fair and reflect what two unrelated companies would have charged each other for the same thing. This is called the “arm’s length principle,” and it’s the foundation of transfer pricing worldwide. It’s laid out in Article 9 of the OECD Model Tax Convention and is there to stop companies from shifting profits to low-tax countries just by manipulating their internal prices.

Here’s where it gets interesting and why it’s not just another tax job. To figure out that “arm’s length” price, you can’t just look at tax law. You have to get into the nuts and bolts of the business itself. You need to understand the entire value chain: Who does what? Where is the real value created? Is it in the R&D, the manufacturing, the marketing, or the distribution? This makes TP a great fit for finance pros who are more into business strategy and economics than memorizing case law. You’re part business strategist, part economist, and part tax advisor.

Transfer pricing career path progressions

One of the best things about a career in transfer pricing is that it offers a clear path for growth and some seriously competitive pay. TP roles can also offer a more predictable schedule, especially as you move up or switch to an in-house position.

From analyst to partner: A clear progression

Whether you start at a big consulting firm or in-house, the career ladder in TP is pretty well-defined. Here’s a general idea of what it looks like:

- Entry-level (interns and junior consultants): This is where you learn the ropes. You’ll spend your days doing benchmarking studies (finding comparable companies and transactions), helping draft parts of TP reports, and doing the financial analysis that underpins every project. It’s all about building your foundational skills.

- Mid-level (senior consultants and specialists): After a couple of years, you become the workhorse of the team. You’re trusted with more complex analyses, you’ll prepare full draft reports for your manager, and you’ll start mentoring the new juniors. This is where you really sharpen your technical expertise.

- Management level (managers and in-house advisors): At this stage, you’re not just doing the work; you’re managing it. You’ll lead projects, handle client relationships (or internal business units), review your team’s work, and conduct interviews to understand a company’s operations. Many experts say the Manager level is often a good time to move from the demanding consulting world to a better-paying in-house role, if becoming a partner isn’t your end goal.

- Senior leadership (directors and partners): At the top, you become the strategic leader. Your focus shifts to high-level client strategy, solving the toughest TP disputes, and bringing in new business. You’re the final word on complex issues and the face of the practice.

What to expect in key global hubs

Let’s talk money. Salaries in transfer pricing are strong from day one and grow a lot as you gain experience, especially in major international business hubs.

- In the UK: If you’re starting out in London, you can expect a salary of around £35,000 while you study for a qualification like the CA. Once you’re qualified (usually after three years), that base can jump to about £58,000. A manager with about five years of experience can pull in a total compensation package of around £75,000. At a Big 4 firm, especially if you’re good at business development, that figure can climb to £90,000-£120,000, as professionals discuss in industry forums.

- In Dubai: The Middle East is a hot market for TP talent. In 2026, a Transfer Pricing Manager in Dubai can expect an average salary of around AED 281,504, with the typical range falling between AED 194,237 and AED 343,434.

Create an ATS-friendly resume with our Resume Builder

Global demand for transfer pricing expertise

A key advantage of transfer pricing is that your expertise is valuable when you cross a border. Your knowledge is your passport, and it’s valid no matter where you go.

The role of OECD guidelines

The secret to this portability is the OECD Guidelines. Think of these as the international rulebook for TP. They provide a common framework and a set of shared principles (like the arm’s length principle) that most countries have adopted into their own local laws.

This means that the fundamental methods, analytical approaches, and economic principles you learn in India are directly relevant in the UK, the US, Dubai, Australia, and dozens of other countries. You’re not learning a local-only skill; you’re mastering a global language of international business.

How transfer pricing compares to other finance roles

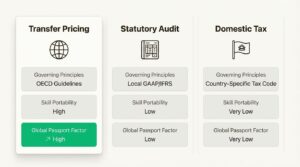

This level of standardization is different from what you find in other finance careers. Let’s compare:

- Statutory Audit: An auditor’s knowledge is tied to specific, local accounting standards. An expert in US GAAP would need retraining and probably a new certification to work in a country that uses IFRS. Expertise is specific to the location’s standards.

- Domestic Tax: As the name suggests, a career in domestic tax is country-specific. Knowledge of the US Internal Revenue Code has little practical use when advising a company in Germany.

Because of this key difference, this career path offers a unique exit option. It gives ambitious professionals a way to go global without the pain of starting over, relearning, and re-certifying. Your experience keeps building, no matter where in the world you earn it.

| Feature | Transfer Pricing | Statutory Audit | Domestic Tax |

|---|---|---|---|

| Governing Principles | Largely harmonized (OECD Guidelines) | Varies by country (IFRS, GAAP) | Highly country-specific |

| Skill Transferability | High | Medium to Low | Very Low |

| Need for Re-certification | Minimal (ADIT is globally recognized) | Often Required (CPA, ACA) | Required |

| Global Opportunities | Abundant in hubs like the US, UK, EU, and Middle East | Good, but often requires local adaptation and certification | Limited |

How to launch your global career

Okay, you’re sold on the “why.” Now for the “how.” Breaking into this field and setting yourself up for a global career is completely doable if you focus on the right skills and look in the right places.

Essential skills for a transfer pricing career

According to senior TP advisor Borys Ulanenko, hiring managers look for candidates with a solid mix of technical and soft skills.

- Technical Skills: You don’t need to be a master on day one, but a good foundation is key. This includes a basic understanding of international tax law, the ability to read financial statements (especially the P&L and balance sheet), and a grasp of core economic principles. And it goes without saying, but you need to be very comfortable with Excel and PowerPoint.

- Soft Skills: This is where good candidates become great professionals. You need to be a persuasive writer, a sharp analytical thinker, and a pro at managing your time. Commercial awareness is also huge. You have to understand the business context behind the numbers.

While a degree in finance, accounting, or economics is the usual starting point, a specialized qualification can really make your resume stand out. A certification like the ADIT certification is globally recognized and highly respected by employers in the US, UK, and across Europe. It shows you have a deep, specialized knowledge of the field. To get there, various platforms offer targeted ADIT preparation courses designed to help you build the kind of expertise top firms are looking for. You can even build foundational knowledge with expert-led courses on core TP concepts by trying a free sample course to see if it’s the right fit.

Where to find transfer pricing jobs

TP professionals are in demand at all sorts of organizations, and where you start can shape your career.

- Big 4 & Consulting Firms: This is the most popular entry point for a reason. Firms like Deloitte, PwC, EY, and KPMG offer top-notch training and exposure to a wide range of industries and complex projects. The trade-off is that the work-life balance can be intense.

- Large Multinationals (In-house): Working directly for a company like Google, Shell, or Unilever means you go deep into one industry. The work-life balance is often better, but career progression can sometimes be slower than in consulting.

- Governmental Institutions: A job at a tax authority like HMRC in the UK or the IRS in the US gives you an invaluable perspective from the “other side.” This experience is highly sought after if you decide to move back to the private sector.

- Boutique & Law Firms: These smaller, specialized firms often handle the most complex and high-stakes TP issues, including litigation. They typically look to hire professionals who already have a few years of experience.

Building your career in transfer pricing

If you’re looking for a career that’s strategic, mentally stimulating, and offers a real chance to work and live around the world, you’ve found it. This career path delivers a rare combination of economics-driven work and unmatched global mobility.

Unlike so many other finance roles that tie you to local rules, TP skills are built on a common international framework that makes your expertise valuable everywhere. This path provides a clear ladder for advancement, from junior analyst to senior leader, with excellent earning potential in the world’s most exciting financial hubs. It’s your ticket to a truly international career.

So, stop just dreaming about that global career and start building it. The first step is arming yourself with the specialized knowledge that top employers are looking for.

Explore our course for practical insights into Direct and International Taxation

Also read: Algorithmic Trading Career for CA: A Practical Roadmap

Frequently Asked Questions

Q.1 What is the biggest advantage of choosing a transfer pricing career path over other finance roles?

A: The biggest advantage is global mobility. Because transfer pricing principles are standardized worldwide by the OECD, your skills are directly transferable to other countries. Unlike audit or domestic tax, you won’t need to completely relearn local rules or get re-certified to work in hubs like London, Dubai, or New York.

Q.2 Is a transfer pricing career path only suitable for tax experts?

A: No. While it’s related to tax, the role is a unique mix of business strategy, economics, and finance. It’s a great fit if you enjoy understanding a company’s entire value chain and business logic more than just memorizing tax law.

Q.3 What salary can I expect at the beginning of a transfer pricing career path?

A: Starting salaries are competitive. For example, in London, you might start around £35,000 as a junior. This can jump to about £58,000 once you’re qualified. Salaries vary significantly by location, with hubs like the US, UK, and Dubai offering strong earning potential.

Q.4 What are the most important skills for a successful transfer pricing career path?

A: You’ll need a blend of technical and soft skills. Technically, a good grasp of financial statements, basic international tax concepts, and Excel is key. For soft skills, strong analytical thinking, persuasive writing, and commercial awareness are what employers look for.

Q.5 How long does it take to reach a manager level in a transfer pricing career path?

A: Typically, you can expect to reach the manager level in about five to six years, especially if you start at a Big 4 or a large consulting firm. At this stage, your role shifts from doing the analysis to managing projects and client relationships.

Q.6 Do I need a special certification for a transfer pricing career path?

A: While not always mandatory to start, a globally recognized certification like the ADIT (Advanced Diploma in International Taxation) can significantly boost your profile. It signals deep expertise and is highly valued by employers in the US, UK, and Europe.