Best AI for FP&A Tools: Features, Pros & Use Cases

Finance professionals today face increasing pressure. The C-suite, the board, and investors no longer just want a report on past performance. They expect finance to be a strategic partner, providing forward-looking insights to guide the business.

Amidst these demands, AI has become a prevalent topic. The challenge for many lies in identifying which tools genuinely deliver on the promise of making teams smarter and faster, and which are just expensive spreadsheets with a fancy logo.

This guide aims to cut through the marketing noise and provide a practical, no-nonsense look at the top AI for FP&A tools that can genuinely make your job easier and your insights sharper. While a powerful tool is a great start, the real career boost comes from developing the strategic mindset to use it well.

What exactly is an AI for FP&A tool?

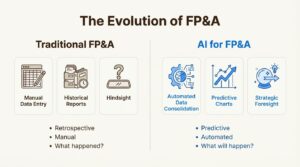

If traditional FP&A focuses on retrospective reporting, using an AI tool is like having a GPS with real-time traffic updates and predictive routing. These platforms are much more than glorified spreadsheets. They are smart systems that use artificial intelligence, specifically machine learning, to automate time-consuming tasks. More importantly, they help shift your focus from hindsight to foresight.

Traditional FP&A is about reporting what happened. AI for FP&A is about forecasting what will happen and stress-testing plans with “what-if” scenarios in minutes, not days.

Here are the core capabilities that make a difference:

- Automated data consolidation: These tools can reduce manual data entry by pulling data from your ERP (like NetSuite), CRM (like Salesforce), and HRIS into a single source of truth.

- Predictive forecasting: This goes beyond simple trend lines. Machine learning algorithms can spot complex patterns in your data that a human might easily miss, leading to more accurate budgets and forecasts.

- Anomaly detection: Get automatic alerts on significant outliers before they become major issues, allowing for proactive investigation.

- Scenario planning: Instantly model the financial impact of a potential market downturn, a new product launch, a price change, or an acquisition. It turns what used to be a week-long project into a much faster process.

The criteria used to pick these tools

This selection is based on criteria relevant for finance professionals working in the trenches day in and day out. Here’s what was considered:

- Ease of use: Is the interface intuitive for a finance professional without a data science background, or will it require months of training?

- Integration power: How smoothly does it connect with the systems you already use? A tool that doesn’t talk to your ERP or CRM is a non-starter.

- AI & forecasting muscle: Does it offer robust, explainable predictive analytics? The numbers it provides must be trustworthy and the logic behind them understandable.

- Collaboration features: Does the tool help you work better with Sales, Operations, and HR, or does it just create another data island?

- Real-world value: At the end of the day, does it save time and lead to smarter, faster business decisions? That is the ROI that truly matters.

A quick look at the top AI for FP&A tools

Here’s a quick, scannable overview of the 5 tools we’ll be diving into.

| Tool | Best For | Starting Price | Key AI Feature |

|---|---|---|---|

| Cube | Teams that love their spreadsheets but need powerful automation and AI insights. | Starts at $32,000 annually. | FP&Ai Suite with conversational agents & smart forecasting. |

| Anaplan | Large enterprises needing complex, cross-functional planning at scale. | Not publicly available. | PlanIQ with ML-driven forecasting powered by Amazon Forecast. |

| Vena | Mid-to-large companies heavily invested in the Microsoft ecosystem (Excel, Power BI). | Not publicly available. | Vena Copilot for conversational queries & reporting. |

| Planful | Mid-market companies looking for a comprehensive, all-in-one FP&A suite. | Not publicly available. | Planful Predict with Signals for anomaly detection. |

| Datarails | SMBs and Excel-native teams wanting a fast and intuitive AI upgrade. | Not publicly available. | Datarails AI with Chat, Storyboards, and Insights. |

A deep dive into the 5 best AI for FP&A tools

Before we get into the details, remember that the “best” tool really depends on your company’s size, budget, existing tech stack, and your team’s affinity for Excel. Let’s break them down.

1. Cube: Spreadsheet-native AI for FP&A

- What it is: Cube is for finance teams who want to keep their existing Excel and Google Sheets models but require a powerful, automated engine running in the background. It acts as a single source of truth that connects directly to your spreadsheets, effectively enhancing their capabilities. It was founded by a three-time CFO, so it’s genuinely built by finance, for finance.

- Pros: Its biggest strength is the seamless, spreadsheet-native experience. This dramatically lowers the learning curve for your team, which means faster adoption and less pushback. The FP&Ai Suite is impressive, offering conversational agents that work right inside Slack and Teams. Its automated variance analysis can save you hours, if not days, during the monthly close. A huge plus is that they offer unlimited users, which is fantastic for growing teams where you don’t want to be nickel-and-dimed for every new hire who needs access.

- Cons: Because it’s so tightly integrated with spreadsheets, it might not be the right fit for teams looking to make a complete break from them. A key limitation some users mention is the lack of deep drill-down capabilities directly within the platform itself. For analysts who need to dig into transactional-level details constantly, this could be a dealbreaker.

- Pricing:

- Custom pricing that starts at $32,000 annually.

- Custom pricing that starts at $32,000 annually.

- Why it’s on the list: It brilliantly solves the “we love Excel, but hate the manual data wrangling” problem. It’s a fantastic choice for mid-market companies that want to add a serious layer of AI and automation without throwing out all their existing workflows.

2. Anaplan: Enterprise-grade AI for FP&A

- What it is: Anaplan is a comprehensive, enterprise-grade solution for what they call “Connected Planning.” This is a robust platform designed to connect planning processes across the entire organization, from finance and sales to supply chain and HR. It’s used by over 2,500 of the world’s largest companies.

- Pros: Anaplan is unmatched when it comes to handling massive datasets and incredibly complex, multi-dimensional business models. Its AI feature, PlanIQ, uses powerful machine learning algorithms (leveraging Amazon Forecast) to generate highly accurate, driver-based forecasts. For a global corporation with multiple business units and currencies, it’s one of the few tools that can handle the sheer scale and complexity required.

- Cons: This capability has implications for cost and implementation. Anaplan has a steep learning curve and often requires specialized, expensive consultants for implementation and maintenance. Its biggest and most frequently cited weakness is data visualization. Users consistently report that its charting and dashboarding capabilities are far behind dedicated BI tools like Tableau or Power BI.

- Pricing:

- Pricing is not publicly available, which is usually a sign that it’s a significant investment geared towards large enterprises. Expect a six-figure price tag.

- Pricing is not publicly available, which is usually a sign that it’s a significant investment geared towards large enterprises. Expect a six-figure price tag.

- Why it’s on the list: For large, complex organizations that need true integrated business planning across dozens of departments, Anaplan is the undisputed heavyweight champion. It’s not for the faint of heart, but for the right company, it’s indispensable.

3. Vena: Microsoft-centric AI for FP&A

- What it is: Vena takes a similar approach to Cube by embracing Excel, but it provides a more structured cloud database and workflow engine on the backend. It positions itself as the #1 AI-powered Complete FP&A Platform and serves as a solution for companies seeking the familiarity of Excel with the control, security, and scalability of a dedicated finance platform.

- Pros: Vena’s core strength is its deep, native integration with the full Microsoft stack. If your company lives and breathes Microsoft 365, Vena will feel like a natural extension of your existing tools. Its AI assistant, Vena Copilot, allows you to ask questions in plain English and works directly within Microsoft Teams. The platform also has rock-solid security, with annual SOC 1 and SOC 2 Type II audits, which is a key consideration for IT departments.

- Cons: While it uses an Excel interface, the underlying complexity of its proprietary database (called CubeFLEX) can still require significant training to master. For advanced visualizations, Vena embeds Microsoft Power BI through a feature called Vena Insights. This works well, but it means you might find yourself managing insights across two different (though integrated) environments, which can sometimes feel less streamlined.

- Pricing:

- Pricing isn’t public, but Vena offers two main plans: Professional and Complete, tailored to different levels of organizational complexity.

- Pricing isn’t public, but Vena offers two main plans: Professional and Complete, tailored to different levels of organizational complexity.

- Why it’s on the list: Vena’s “embrace and extend” approach to Excel makes it a powerful choice for finance teams who want to graduate from standalone spreadsheets but aren’t ready to give up the interface they know and love. Its Microsoft-centric world is a huge draw for many companies.

4. Planful: All-in-one AI for FP&A

- What it is: Planful aims to be the all-in-one solution for the office of the CFO. It’s a comprehensive cloud FP&A platform that covers financial planning, consolidation, financial close, and reporting. Its approach to AI is to make it practical by embedding it across the entire platform.

- Pros: Planful’s main advantage is its breadth. You can manage almost your entire FP&A and accounting cycle in one place. Its AI suite, Planful Predict, is very practical. It includes Predict: Signals, which automatically flags anomalies and potential errors in your data, and Predict: Projections, which generates unbiased forecasts to challenge your own assumptions. The platform is designed for a fast time to value, with many customers getting up and running in weeks, not months.

- Cons: As an all-in-one platform, some users report that certain modules feel less mature or feature-rich than best-of-breed, standalone tools. For instance, some customer reviews note its data visualization scores lower than its competitors, suggesting it’s more of a planning workhorse than a powerful BI and analytics tool.

- Pricing:

- Pricing is not public and is typically positioned for the mid-market.

- Pricing is not public and is typically positioned for the mid-market.

- Why it’s on the list: Planful is a fantastic all-in-one option for a growing finance team that is tired of juggling multiple disconnected processes. It allows you to consolidate everything onto a single, AI-enabled platform without a massive, multi-year IT project.

5. Datarails: Agile AI for FP&A for SMBs

- What it is: Datarails is an agile, Excel-native FP&A platform built specifically for the finance teams at small to mid-sized companies. Like Cube and Vena, it automates data consolidation and reporting without forcing you to abandon your existing spreadsheets and financial models.

- Pros: Datarails is known for its simplicity and rapid implementation. Most customers are set up and seeing value in just 4-6 weeks. Its AI suite, Datarails AI, is highly intuitive. It features a Chat for asking natural language questions, Storyboards for turning raw data into polished presentations in just two clicks, and Insights for proactive analysis that surfaces trends you might have missed. Another often overlooked plus is that their customer success team is staffed by people from a finance background. They speak your language.

- Cons: It’s built for agility and SMBs. This means it might lack the deep, multi-dimensional modeling capabilities and complex workflow controls that a massive enterprise would need from a platform like Anaplan. It is designed for agility rather than the complex modeling required by large enterprises.

- Pricing:

- Pricing is not publicly available, but they offer tiered plans like Professional, Premium, and Expert based on company size and needs.

- Pricing is not publicly available, but they offer tiered plans like Professional, Premium, and Expert based on company size and needs.

- Why it’s on the list: Datarails is an excellent entry point into AI for FP&A. It’s perfect for smaller teams who live in Excel and want to see immediate value from automation and AI-driven insights without a painful, six-month implementation process.

Beyond the tool: Essential skills for success

Experience shows that the effectiveness of an AI tool depends heavily on the user. Implementing an AI tool is only the first step; true value comes from how it is used.

- Garbage in, garbage out. This is the oldest rule in data, and it’s truer than ever with AI. An AI model is only as good as the data you feed it. A tool can’t fix a messy chart of accounts, inconsistent data entry, or siloed information. Before investing in software, it is crucial to get data governance in order.

- AI gives you the ‘what,’ you still need to explain the ‘why’. An AI can flag a 20% variance in marketing spend in seconds. That’s the easy part. But it can’t tell you that the team launched a last-minute Diwali campaign that, while expensive, drove a massive spike in qualified leads and sales. That requires business acumen. Your job isn’t to present the AI’s output; it’s to build a compelling business story around it.

- Become the “AI Translator.” The most valuable finance professionals in the next decade will be those who can understand an AI’s output, validate it with their own industry knowledge, and translate it into an actionable strategy for leadership. This is the skill that transforms you from a number-cruncher into a true strategic partner.

This highlights the importance of developing skills beyond software operation. An effective finance professional needs strategic thinking, business partnering skills, and the data storytelling ability to ask the right questions and drive real impact. For those looking to develop these competencies, our FP&A Masterclass is designed for precisely that.

The Next Step

Using AI for FP&A is no longer a futuristic option; it’s rapidly becoming the standard for high-performing finance teams. These tools are the key to moving from reactive reporting to the proactive, strategic guidance that the business desperately needs from you.

The technology should be viewed as an enabler. It is a powerful assistant that automates the repetitive parts of your job, freeing you up to focus on the high-impact, strategic work you were actually hired to do. The future of finance belongs to those who learn to partner with AI effectively.

For professionals ready to build the skills to not just use these tools, but to lead with them, check out our AI for Finance Program. We’ll help you become the tech-savvy, strategic finance leader that top companies are fighting to hire.

Also read: Investment Banking vs. Statutory Audit: Salary & Growth Reality Check