Budget 2026 predictions: 5 tax reforms every CA should watch out for

It’s that time of year again. As the date for the Union Budget approaches, finance professionals across the country are anticipating its release. With the Finance Minister set to present the budget on February 1st, we are on the verge of some potentially significant shifts in India’s tax landscape. This year is particularly interesting because it will be the first budget presented under the new Income-tax Act, 2025.

What should we be looking out for? Instead of speculation, this analysis is based on available data and reports. We reviewed expert analysis from leading firms like Deloitte, EY, and Grant Thornton, as well as the official wish list submitted by the Institute of Chartered Accountants of India (ICAI). This post is your preview of the five most significant tax reforms that could directly impact your work, including tax compliance, advisory services, and the overall economic environment for your clients.

Union Budget 2026 Expectations

We know you’re busy, so our selection of these predictions is based on thorough research. The five reforms we’re about to break down are based on recurring themes in public discourse and expert analysis. We’re talking about the pre-budget reports from leading firms, specific demands from industry bodies like NASSCOM, and most importantly, the official submissions made by the ICAI pre-budget suggestion. Our goal was to focus on the potential changes that will directly affect your work and change how you advise everyone from individual taxpayers to large corporations.

A Quick Comparison

Before we dive deep, here’s a high-level look at the key reforms we’ll be discussing and who stands to gain the most if they become a reality.

| Potential Reform | Area of Impact | Primary Beneficiary | Perceived Likelihood |

|---|---|---|---|

| Personal Tax Relief | Personal Taxation | Salaried Individuals, Families | High |

| Capital Gains & M&A Clarity | Investment & Corporate Finance | Investors, Corporates | Medium |

| ICAI Recommendations | Professional Compliance | CAs, MSMEs, Non-residents | High |

| TDS & Compliance Simplification | Tax Administration | All Businesses | High |

| Incentives for Employment & Tech | Corporate Taxation | Tech Sector, Manufacturing | Medium |

5 key reforms in the Budget 2026 expectations

As the country awaits the official announcements, here are the five most talked-about reforms that could impact the tax landscape for the next financial year.

1. Personal tax relief

What it is:

This is probably one of the most anticipated items on the list. There’s a widespread expectation that the government will introduce more relief for individual taxpayers, particularly salaried individuals. With the new tax regime now being the default option, the focus is on making it more attractive. The chatter suggests a higher basic exemption limit. But that’s not all; there’s also a strong push for a higher deduction limit for home loan interest under Section 24(b), potentially bumping it up from the current ₹2 lakhs to ₹3 lakhs. This would be a significant relief for homeowners facing rising interest rates.

Why it matters:

The middle class has been facing financial pressure. Any move to put more money back in their pockets is a welcome one. It boosts consumption, which in turn fuels economic growth. The numbers back this up. Grant Thornton notes that over 75% of taxpayers had already switched to the new regime even before its last update, showing a clear appetite for simplification. On top of that, the ICAI has also suggested an interesting idea: an optional joint taxation scheme for married couples. This could streamline tax filing for families and potentially offer a more favorable tax outcome, depending on how it’s structured.

Impact on CAs:

If these changes go through, you will likely receive many client inquiries. You’ll need to immediately re-evaluate tax plans for all your salaried clients to see if the new regime, with its potential enhancements, makes more sense for them. An increased home loan interest deduction means recalibrating tax savings calculations for clients with mortgages. And if that joint taxation scheme becomes a reality? That opens a new area of advisory, turning you into a key strategist for family tax planning. It’s more work, sure, but it is also an opportunity to provide high-value advice.

2. Clarity on capital gains and M&A taxation

What it is:

While the last budget made some headway in simplifying capital gains tax, there are still some ambiguous areas that create uncertainty. One of the most significant challenges is the taxation of contingent considerations in M&A deals. This refers to situations where part of the payment for a business sale depends on its future performance. Right now, figuring out the tax implications for these “earn-out” structures is a significant challenge. The industry is hoping for clear, unambiguous rules on how to handle these situations.

Why it matters:

Uncertainty can be a major obstacle for business. When companies can’t confidently predict the tax bill on a merger or acquisition, it makes deal-making way more complicated and risky. This ambiguity can stall negotiations, inflate costs due to legal consultations, and sometimes even prevent deals from proceeding. As industry experts have repeatedly pointed out, providing a clear tax roadmap for M&A would be a significant boost to the ease of doing business in India. It would make the country a more attractive destination for both domestic and foreign investment, encouraging more strategic consolidation and growth.

Impact on CAs:

For any CA working in corporate finance or M&A advisory, this clarification would be a significant help. Clear guidelines would reduce the time spent discussing the interpretation of vague tax laws with your clients and the opposing counsel. Clear guidelines would streamline your advisory work, significantly reduce the risk of future litigation for your clients, and make the complex processes of valuation and tax liability calculation much more straightforward. You’d be able to provide faster, more confident advice, which is exactly what clients need when navigating a high-stakes M&A transaction.

3. Key ICAI recommendations

What it is:

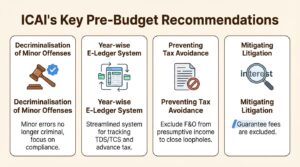

The ICAI’s recommendations are often considered by the Finance Ministry. The institute’s official Pre-Budget Memorandum is a valuable source of practical suggestions aimed at making life easier for both taxpayers and professionals. It’s essentially a set of recommendations from the CA community, focused on reducing litigation and cutting down on unnecessary compliance burdens. These are targeted fixes for real-world problems that CAs and their clients face every single day.

Why it matters:

The ICAI’s press release gives us an authoritative glimpse into what our profession is pushing for. Here are some of the standout suggestions:

- Decriminalisation: The 2025 budget started a positive trend of decriminalizing minor tax offenses. The ICAI is pushing for this to continue, arguing that honest mistakes or small procedural lapses shouldn’t carry the threat of criminal proceedings.

- Year-wise E-Ledger: To simplify the messy process of claiming credit for TDS/TCS and advance tax, the ICAI has proposed a new, streamlined e-ledger system. This would make it much easier to track payments and adjustments for a specific assessment year.

- Preventing Tax Avoidance: The ICAI has suggested excluding F&O and other speculative trading activities from presumptive income schemes. This is a move to close a loophole that could be used for tax avoidance.

- Mitigating Litigation: A technical but important point is the proposal to exclude guarantee fees from the definition of ‘interest’. This would prevent unnecessary disputes over limitations on interest deductions for businesses.

Impact on CAs:

These reforms are designed by CAs, for CAs. Implementing them would directly address some of the most significant administrative and legal challenges in the profession. A more rational approach to decriminalization reduces risk for professionals and their clients. A better e-ledger system means less time spent on time-consuming reconciliations and more time on strategic advice. Closing tax loopholes strengthens the integrity of the system, and clarifying definitions like ‘interest’ prevents years of potential litigation. Essentially, these changes would free you up from time-consuming paperwork and legal disputes, allowing you to focus on what you do best: helping your clients grow.

Create an ATS-friendly resume from our Resume Builder.

4. Simpler TDS and compliance norms

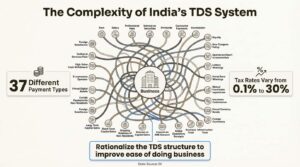

What it is:

If there’s one area of tax law often considered complex, it’s Tax Deducted at Source (TDS). The current framework is a complex set of rules that could be simplified. A major push is expected in this budget to rationalize the TDS structure and cut down on other compliance red tape to improve the overall ease of doing business. This isn’t just about tweaking a few rates; it’s about rethinking the process to make it less burdensome for everyone involved.

Why it matters:

The complexity is notable. According to EY, businesses currently have to navigate 37 different types of payments that are subject to TDS, with rates that vary widely from 0.1% to 30%. This not only creates significant confusion but also leads to frequent errors and litigation. Another long-standing demand that’s gaining traction is to allow individuals with global income to claim their Foreign Tax Credit. Currently, they have to wait until they file their tax returns to claim this credit, which impacts their cash flow. Allowing the credit at the source would be a significant relief.

Impact on CAs:

A rationalized TDS structure would be a significant benefit for your practice. Think about the significant time you and your team spend just trying to keep up with the various rates, thresholds, and filing requirements. Simplifying this would significantly reduce compliance time, reduce the likelihood of errors (and subsequent notices), and free up your resources for more valuable work. For CAs who handle clients with international income—like freelancers, executives with ESOPs from foreign companies, or NRIs—allowing FTC claims at the source would be a significant help. It would immediately improve your clients’ cash flow and simplify their tax affairs, providing immediate value to your clients.

5. Employment and tech incentives

What it is:

Every budget aims to be forward-looking, and this one is expected to be no different. The two big focus areas are likely to be job creation and boosting investment in futuristic technologies like Artificial Intelligence (AI) and robotics. This could come in the form of enhanced tax benefits for hiring new employees and extending successful incentive schemes to cover sunrise sectors important for India’s economic future.

Why it matters:

The government wants to create jobs, and the tech industry is a key engine for that. To encourage hiring, NASSCOM has put forward a recommendation: raise the salary limit for claiming deductions under Section 80JJAA from the current ₹25,000 to ₹100,000 per month. This change would make the incentive more relevant for the IT sector, where salaries have long surpassed the old limit. On the technology front, industry leaders are hopeful that the government will expand its successful Production-Linked Incentive (PLI) schemes. Extending these schemes to cover AI, robotics, and space technology would send a strong signal that India is serious about becoming a global hub for innovation.

Impact on CAs:

These incentives create direct advisory opportunities. If the 80JJAA limit is increased, you can proactively reach out to your corporate clients, especially in the IT and BPO sectors, and help them claim what could be a very significant tax benefit on their new hires. It’s a tangible way to save them money. Furthermore, if new PLI schemes are announced for emerging tech, it could create an entirely new advisory vertical for your firm. You could specialize in helping tech startups and established companies navigate the application process and structure their operations to maximize these government incentives, positioning you as a partner in their growth.

Union Budget 2026 expectations

Regardless of which of these predictions materialize, one thing is certain: the budget will create a fresh set of challenges and opportunities for every Chartered Accountant. The key to navigating the post-budget period is to be prepared. Being the first to understand the changes and communicate them clearly to your clients is a key differentiator for CAs.

This is an opportunity to provide value. Advise them to review their internal processes, update their accounting software, and get ready for any new compliance requirements. Emphasize that in a rapidly changing environment, staying informed with reliable analysis is an effective way to add value to their business.

Final thoughts

So, to recap, the five key areas we’re all watching are potential personal tax relief for the middle class, much-needed clarity on capital gains, the implementation of pivotal ICAI recommendations, a major simplification of the TDS framework, and new incentives to boost technology and employment.

These potential reforms signal a clear government focus on making compliance easier while strategically boosting key sectors of the economy. But of course, this is all just informed speculation until the Finance Minister takes the floor. The full, official picture will only emerge after the speech tomorrow.

The budget speech is often long and contains technical language.

Empower Your Career With Financial Due Diligence Masterclass

Also read: Why Financial Due Diligence is the Role for Freshers?