What is Financial Planning and Analysis (FP&A)? (2026 Updated)

FP&A Meaning | Introduction:

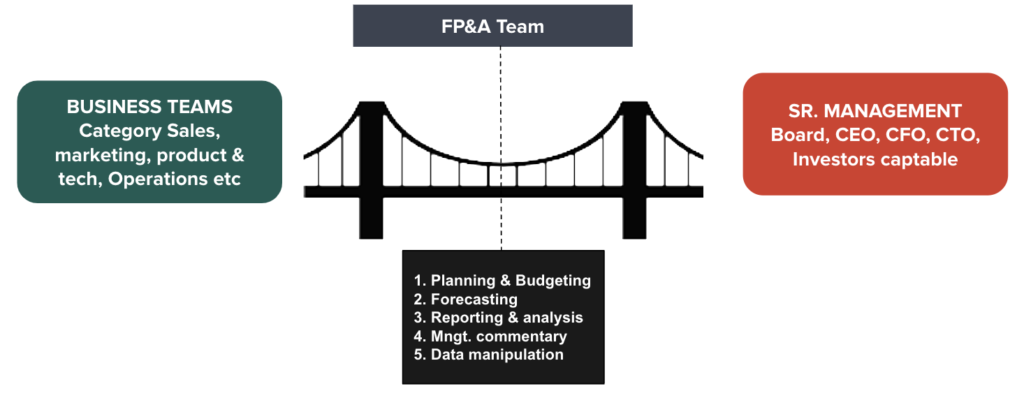

Financial planning and analysis (FP&A) is a critical function in any organization. It helps businesses make informed decisions about how to allocate resources and achieve their strategic goals.

In the Indian context, FP&A is particularly important given the country’s rapidly growing economy and competitive business environment. Companies need to be able to quickly and accurately assess their financial performance and make adjustments to their plans as needed. FP&A professionals are expected to often work closely with senior management and other departments to ensure that financial goals are aligned with overall business objectives.

In the Indian context, FP&A is particularly important given the country’s rapidly growing economy and competitive business environment. Companies need to be able to quickly and accurately assess their financial performance and make adjustments to their plans as needed. FP&A professionals are expected to often work closely with senior management and other departments to ensure that financial goals are aligned with overall business objectives.

Also Read: What is Internal Audit? Why does it matter?

Key responsibilities of FP&A professionals:

Preparing financial reports & budgets

- FP&A professionals meticulously compile financial statements and budget outlines to ensure accurate financial tracking and compliance with regulatory standards.

Analyzing financial and operational data to gather insights

- They delve into data, using advanced analytics to uncover underlying patterns and insights that drive strategic business decisions.

Developing financial forecasts & plans

- These experts create detailed forecasts to predict future financial outcomes, aiding companies in preparing for upcoming challenges and opportunities.

Providing financial advice to management & approving all major expenses (POs)

- FP&A teams offer strategic financial guidance and scrutinize major expenditures to maintain budget integrity and support organizational objectives.

Supporting business decision-making through prudent financial planning

- Their financial planning efforts are crucial for equipping management with the tools and insights needed to make informed, strategic business choices.

Managing financial & business risks through stress testing all numbers

- By rigorously testing financial scenarios, FP&A professionals help identify potential risks and develop mitigation strategies to safeguard the organization’s interests.

Understanding the Variations & Terminology

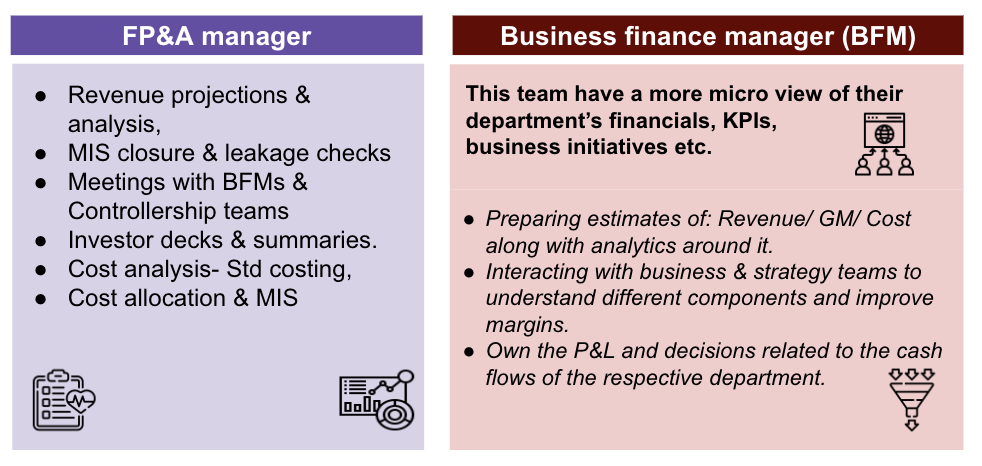

You might hear FP&A and Business finance being used interchangeably a few times as well. There are different terminologies that may appear on job listings- Business finance analyst, FP&A manager, finance business partner, Bizfin superstar etc.

While there is a lot of variation, and companies often take liberty to define work profiles, sometimes even camouflage accounting-recon roles within them, here’s a quick most standard difference:

Conclusion and Additional Resources:

Preparing for an FP&A interview requires not just knowledge and skills, but a strategic approach to showcasing your qualifications. Our Financial Planning & Analysis Masterclass is designed to provide you with comprehensive training that covers all aspects of FP&A, from fundamental concepts to advanced financial modeling techniques. This masterclass will help you build confidence and enhance your abilities to tackle even the most challenging interview questions effectively.

Ready to take your FP&A career to the next level? Enroll in our Financial Planning & Analysis Masterclass today and gain the edge you need to succeed in your next interview. Enroll Now