KPMG Case Study: Unmasking Emerging Fraud Trends in Indian Manufacturing Sector

Introduction to Fraud Trends in Indian Manufacturing Sector

The Indian manufacturing industry, particularly the automotive and industrial manufacturing (Auto & IM) sectors, is accelerating toward a USD 1 trillion export goal by 2030. With double-digit growth—12.1% overall in the last fiscal and 12.5% in the automotive segment—the sector is poised to become a global manufacturing powerhouse. However, this transformation has given rise to sophisticated fraud schemes that threaten operational integrity and long-term profitability.

This blog unpacks the latest fraud trends in the Indian manufacturing sector, backed by insights from a comprehensive KPMG survey. From procurement collusion and sales manipulation to dealership kickbacks and misuse of authority, we explore where fraud risks are emerging, how they’re evolving, and what proactive steps industry leaders must take to safeguard their organizations. Whether you’re in finance, compliance, or internal audit—this is your roadmap to building fraud resilience in a rapidly changing business environment.

The Scope of the Survey: A Deep Dive into Real-World Risks

To understand how fraud is impacting the automotive and industrial manufacturing sectors, KPMG in India conducted a detailed survey. This wasn’t just a surface-level study—it involved professionals who are directly responsible for identifying and managing fraud across their organisations.

The participants came from different departments, giving a well-rounded view of the issue:

70% from internal audit teams, who are on the front lines of risk and control

10% from compliance departments, responsible for ensuring rules are followed

10% from ethics committees and legal teams, focused on integrity and accountability

10% from finance and other operations leaders, who deal with numbers and business processes daily

These experts were asked about the types of fraud their organisations are experiencing, where the fraud is happening, and how they’re dealing with it.

What emerged from this survey is eye-opening:

Fraud is no longer limited to one area or type. It’s becoming more widespread, complex, and harder to detect—especially as organisations adopt new technologies and expand operations.

By collecting these insights, the survey gives us a clear picture of:

Which departments are most vulnerable

Who is committing the fraud

Why it’s happening

And how companies are responding

High-Risk Zones: Where Fraud Is Happening Most

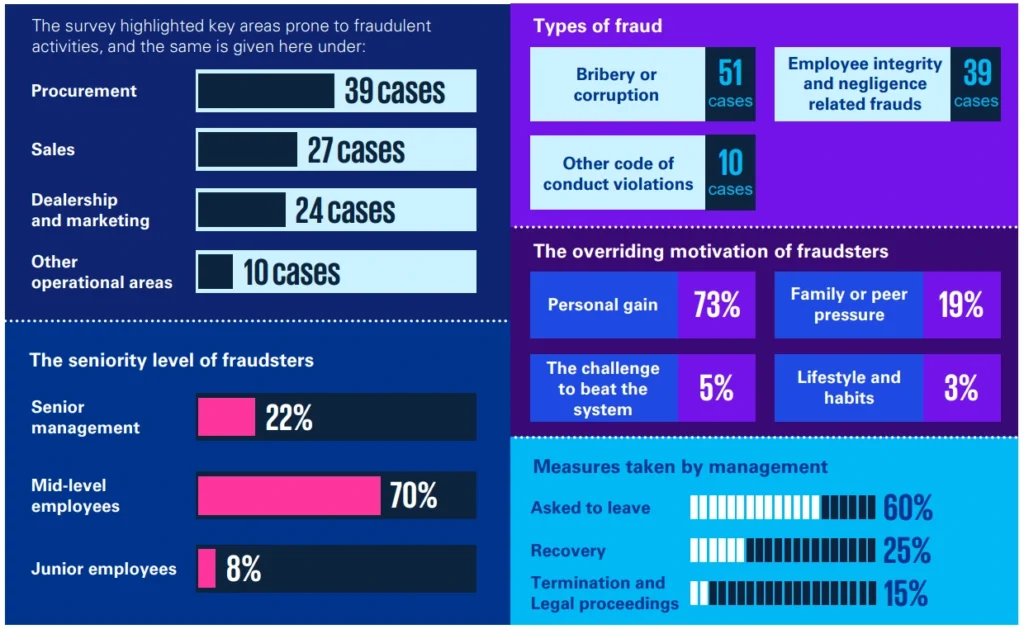

Fraud doesn’t strike randomly. It tends to happen in specific, high-risk areas of the business where controls are weak or where people have more power to bend the rules. According to the KPMG survey, these are the four areas most vulnerable to fraud in the Indian Auto and Industrial Manufacturing sector:

1. Procurement – 39 cases reported

This is the most affected area. Fraud in procurement often involves employees colluding with vendors to inflate prices, approve unnecessary purchases, or create fake supplier accounts. In many cases, employees receive bribes or gifts in return.

2. Sales – 27 cases reported

In the race to hit targets, some employees manipulate sales data—either to show higher revenue or to earn bigger bonuses. Others might process fake returns or give unauthorized discounts to help dealers or customers.

3. Dealership & Marketing – 24 cases reported

Fraud in this space includes kickbacks from dealers, sharing confidential information to help preferred partners, or even misusing marketing budgets. Sometimes, marketing campaigns are run just to funnel money to insiders or external parties.

4. Other Operational Areas – 10 cases reported

These are less frequent but still significant. Examples include:

Selling usable inventory as scrap for personal gain

Approving expenses without proper checks

Conflict of interest with third-party vendors

What This Means for Businesses

These numbers show that fraud is not limited to finance or compliance—it’s happening across departments. Any area with money flowing in or out, especially where external vendors and dealers are involved, becomes a hotspot for fraud.

To tackle this, businesses must focus on:

Stronger checks in procurement and sales

Greater transparency in dealership relationships

More oversight on marketing and operational spending

Detection Realities: What’s Working—and What’s Not

Detecting fraud has become more challenging than ever. As fraudsters get smarter and more creative, companies need sharper tools and faster systems to stay ahead. The good news? Some methods are proving highly effective. But there are also clear gaps that businesses must address.

Whistleblowing: The Most Powerful Line of Defense

According to the KPMG survey, nearly 80% of frauds were uncovered through whistleblowing. This includes:

Anonymous hotline tips

Direct complaints to senior management

Internal reporting by observant employees

This clearly shows that when employees feel safe to speak up, they become the eyes and ears of the organisation. But for whistleblowing to work well, it needs:

A confidential reporting system

A zero-tolerance policy for retaliation

Regular communication about how and why to report concerns

Fraud Risk Assessments: Catching Issues Before They Explode

Many companies are now conducting regular fraud risk assessments, especially in areas like procurement and sales. These assessments help spot red flags early and identify:

High-risk vendors

Unusual patterns in purchases or discounts

Gaps in internal controls

When done proactively, this process helps prevent fraud before it starts—rather than reacting after the damage is done.

Using Technology for Early Detection

Modern fraud doesn’t always leave a paper trail. That’s why advanced analytics and automation tools are becoming essential. These tools can:

Analyze huge volumes of transactions

Detect patterns or behaviors that point to fraud

Alert teams when something looks off

Early warning systems powered by technology save time, reduce manual work, and increase accuracy in fraud detection.

Conclusion

Fraud in the Indian automotive and industrial manufacturing sectors is no longer an isolated event—it’s a systemic risk that grows with scale, speed, and complexity. The KPMG survey highlights not only where fraud is occurring but also how it’s evolving—from procurement scams and sales manipulation to digital blind spots and dealer collusion.

What’s clear is this: detection and prevention must evolve too.

Leadership teams must champion this shift—not just to reduce financial losses, but to protect brand reputation, investor trust, and long-term competitiveness.

In a high-growth sector on the path to becoming a global manufacturing hub, companies that proactively tackle fraud will outperform, outlast, and out-innovate those that don’t.

Because in today’s market, resilience isn’t a nice-to-have—it’s a strategic advantage.

Join our Forensic Audit Masterclass and elevate your investigative skill

Looking for Opportunities?

Join the exclusive WhatsApp group to learn, network, and win together!