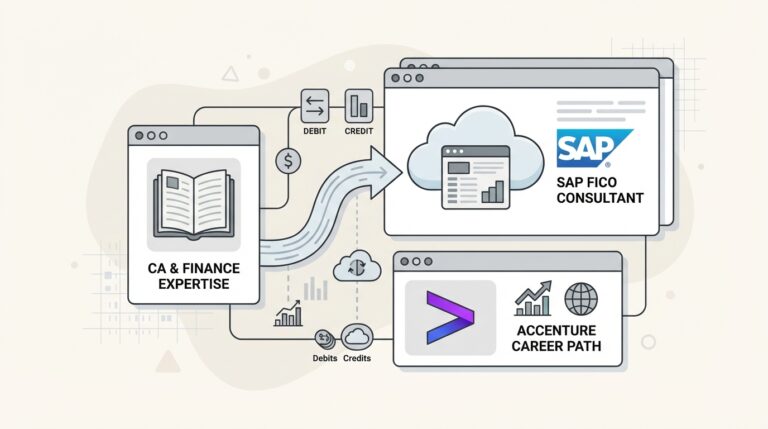

How CAs can become SAP Functional Consultants at Accenture?

If you’re a Chartered Accountant, you probably know the typical career roadmap. You grind through your articles, pass the exams, and then land in audit, tax, or maybe a corporate finance role. It’s a solid, respectable path. But what if you’re more interested in systems and logic than vouching and tax codes?

What if you could take all that deep financial knowledge and apply it to a high-growth tech career, without writing a single line of code?

It’s not a hypothetical. It’s the reality for CAs who pivot to become SAP Functional Consultants. This is more than just a job change; it’s a chance to get to the core of how businesses really run. Here’s a clear roadmap for how you can make this exact transition and land a role at a global firm like Accenture.

What is an SAP functional consultant?

First things first, let’s clear up what this role is all about. You’ve probably used SAP before. It’s the powerhouse Enterprise Resource Planning (ERP) software that huge companies use to manage everything from financials and supply chain to HR. Think of it as the central nervous system for a global corporation.

So, what does a Functional Consultant do? The key thing to know is this: they are not coders. They are business process architects. Their job is to understand a company’s unique financial needs and then configure the standard SAP system to meet them.

The best way to think about it is as a translator. On one side, you have the finance department talking about debits, credits, P&L statements, and compliance. On the other, you have the powerful but complex SAP system. The Functional Consultant stands in the middle, fluent in both languages. They take the business requirements from the finance team and translate them into the correct logic and settings within SAP.

For CAs, the sweet spot is in the Financial Accounting (FI) and Controlling (CO) modules, often just called “SAP FICO.” These are the core parts of SAP S/4HANA Finance, the engine that handles a company’s books. Instead of being an end-user posting journal entries, you become the person who designs how the entire system posts those entries for thousands of users. You’re not just using the software; you’re shaping it to enable flawless accounting for some of the world’s biggest companies.

CA is ideal for an SAP functional consultant

Here’s the part that trips a lot of people up. They assume you need a computer science degree to get into a tech role like this. That couldn’t be further from the truth. The most critical skill for an SAP Functional Consultant is deep domain expertise in business processes, which is something CAs have in spades. It’s a sentiment you’ll find echoed by plenty of professionals who’ve made the same switch.

Let’s break down how your core skills as a CA map directly to what makes a great SAP consultant.

You already understand the ‘why’ behind the numbers

As a consultant, you need to grasp end-to-end business cycles like procure-to-pay (from ordering goods to paying the vendor), quote-to-cash (from giving a customer a price to getting paid), and record-to-report (the whole process of closing the books). These processes are the bedrock of SAP’s financial management solutions.

As a CA, you’ve spent your career auditing or managing these exact flows. You don’t just know what a three-way match is; you understand why it’s a critical internal control to prevent fraud. That contextual understanding is priceless. When a client says they need a new workflow for vendor invoice approvals, you’re already thinking about segregation of duties and potential control weaknesses, letting you design a better, more robust solution in SAP.

You speak the client’s language

Imagine being in a workshop with a company’s CFO and corporate controller. A huge part of being a consultant is gathering their requirements, understanding their pain points, and getting their buy-in.

If you walk in as a CA, you have instant credibility. You get their terminology, from IFRS 16 lease accounting to intercompany reconciliations and understand the pressure they’re under during month-end close. You can have an intelligent conversation about how to ensure the system configuration remains compliant with GAAP or IFRS rules. You’re not just a “tech person”; you’re a finance peer who happens to specialize in technology. This ability to connect and build trust is often the difference between a project succeeding or failing.

A natural talent for logic and rules-based systems

At its core, accounting is a rules-based system. You follow a set of principles (debits on the left, credits on the right) to make sure the books balance. It’s all about logic, structure, and precision.

Configuring SAP is exactly the same. It’s a massive, rules-based system where you define how transactions should be posted, how financial reports should be generated, and how data should flow. The logical, systematic thinking drilled into you during your CA training is the perfect mindset for configuring the complex financial modules in SAP S/4HANA. You’re just applying that same talent to a different, more dynamic puzzle.

| CA Skillset | How it Applies to an SAP Consultant Role |

|---|---|

| Deep Accounting Knowledge | Designing the chart of accounts, configuring tax codes, and ensuring GAAP/IFRS compliance within SAP S/4HANA. |

| Business Process Auditing | Analyzing a client’s “as-is” financial processes and designing efficient “to-be” processes in SAP. |

| Analytical & Problem-Solving | Troubleshooting configuration issues and identifying the root cause of financial discrepancies in the system. |

| Client Communication | Leading requirement-gathering workshops with senior finance stakeholders and explaining technical concepts simply. |

| Attention to Detail | Ensuring precise configuration of financial settings where a small error can have a huge impact. |

Become a SAP consultant at Accenture

Okay, you’re convinced. This sounds like a great fit. So how do you actually make the leap, and why is Accenture the place to do it?

First, let’s talk about Accenture’s position in this space. The company has a strategic partnership with SAP that goes back over 40 years. This partnership includes co-developing solutions with them. For example, HFS Research named Accenture the #1 provider for SAP S/4HANA services. This means working within a large SAP ecosystem.

Here’s a practical path to get there.

Gaining relevant experience and skills

You don’t need to quit your job and get a whole new degree. The best way to start is by using your current role. Many CAs have found that hands-on experience as an SAP end-user is incredibly valuable.

Look for opportunities within your company. Is there an upcoming SAP upgrade or implementation? Raise your hand. Volunteer to be a “super user” or a subject matter expert for the finance team. This gives you direct exposure to how the system is designed and configured. You’ll get to work alongside consultants, see how they operate, and learn the language. This real-world experience is far more valuable than any textbook.

To formalize your knowledge, consider getting a course like the SAP FICO Masterclass. It proves you have the foundational knowledge and are serious about making the switch.

What Accenture looks for in an SAP functional consultant

So, what does it take to actually land the job? A typical SAP Finance Consultant role at Accenture gives us some great clues.

They usually look for a minimum of four years of experience and, ideally, involvement in at least two full, end-to-end SAP S/4HANA implementations. This shows you’ve seen a project from the initial design phase all the way through to go-live and support.

But it’s not just about technical experience. The job descriptions emphasize soft skills. They want people with a “passion for storytelling” and the ability to confidently engage with senior clients. This goes back to the translator concept: you need to be able to explain complex system changes in a way that a non-technical executive can understand.

There’s also a growing focus on the next wave of technology. Candidates are expected to be able to “Clearly explain SAP’s Business AI strategy” and identify opportunities where it can create real value for clients. This shows that the role is constantly evolving beyond simple configuration to strategic technology advisory.

A culture of continuous learning and growth

The thought of switching careers can be intimidating. You might feel like you don’t know enough to even start. This is an area where a large consulting firm can provide significant support. They don’t expect you to be an expert on day one. As an example, Accenture invests over $1 billion every single year in learning and professional development.

Through its close partnership, Accenture offers personalized learning services from SAP, giving you access to specialized training, Nanodegree programs, and certifications to keep your skills sharp.

More importantly, you’re not learning in a vacuum. When you join a large firm, you become part of a global community. For instance, Accenture has over 88,000 SAP experts. This can be a valuable network of mentors and colleagues. The environment is often designed for growth, with resources to help you succeed.

Understanding the compensation potential

Let’s be practical: a career change has to make financial sense. The good news is that pivoting to a tech consulting role is often a very lucrative move.

Looking at actual job postings gives a concrete example. An SAP Finance Consultant role based in California can have a salary range from $70,350 to $196,000 a year. A salary of ₹35–40 Lakhs in Bangalore or Mumbai often provides a similar or higher quality of life due to the lower cost of living in India. Of course, the exact amount depends on your experience, location, and specific skills. On top of the base salary, these roles typically come with a full suite of benefits, performance bonuses, and generous paid time off. It’s a package designed to attract and retain top talent.

Build your future at the heart of change

For a Chartered Accountant, a career as an SAP Functional Consultant isn’t a leap into the unknown. It’s a logical and rewarding evolution and a path that takes the financial expertise you’ve worked so hard to build and channels it into a dynamic, non-coding tech role focused on transforming how the world’s best companies run.

It’s a chance to move from analyzing the past to building the future. And a company like Accenture can be a partner in that reinvention. It can provide the projects, training, and supportive culture needed to successfully make the transition and build a career at the intersection of business and technology.

Your financial expertise is valuable in the tech world. If you are ready to move from balancing the books to building the systems that run global finance, you can explore a career as an SAP Functional Consultant at Accenture.

Check out our masterclass on SAP FICO.

Also read: CA in banking: How to crack the “Credit Manager” interview (HDFC/ICICI/Kotak)

Frequently Asked Questions

Q.1 What is the biggest advantage for a CA in an SAP functional consultant role?

A: Your deep understanding of finance and business processes is your biggest asset. This domain expertise is valued because you can speak the client’s language and design SAP solutions that solve real-world accounting challenges, something pure tech specialists can’t do as effectively.

Q.2 Do I need coding skills to become an SAP functional consultant?

A: No, this is a non-coding role. Your job is to configure the SAP system using its built-in tools, not to write code. You’ll be translating business needs into system logic, which leverages your analytical skills, not programming skills.

Q.3 What’s the typical career path for an SAP functional consultant?

A: The growth potential is significant. You can advance to roles like Senior Consultant, Manager, and Senior Manager, leading larger projects and teams. You can also specialize in niche areas of SAP Finance or move into solution architecture, where you design high-level solutions for global clients.

Q.4 How can a large firm support a CA transitioning to an SAP functional consultant role?

A: Large firms often invest heavily in training. For example, Accenture provides access to personalized SAP learning programs, certifications, and a global network of over 88,000 SAP experts. They provide the resources and mentorship to help you successfully transition from a finance background to a tech consulting career.

Q.5 Is prior SAP experience mandatory to become an SAP functional consultant?

A: While direct consulting experience isn’t always required, some exposure to SAP is highly valued. Experience as an SAP end-user or participating in an SAP implementation project at your current company can be a huge advantage and is often what hiring managers look for.