Internal Audit vs ERM Risk Management for CAs CA Monk

If you’re a Chartered Accountant in audit, you’ve probably had one of those days. You know the one, where you’re buried in last quarter’s transactions, ticking off another compliance checklist, and wondering if this is what making a real impact feels like. The work is important, for sure, but it’s all about looking in the rearview mirror.

Internal Audit is classic detective work. You show up after the fact to figure out what went wrong, making sure all the rules were followed.

But what if you could change the game? What if, instead of just keeping score, you could help write the playbook for the company’s future?

That’s where Enterprise Risk Management (ERM) comes in. It’s a forward-looking discipline that puts you at the table with leadership, helping them navigate what’s coming and grab opportunities. It’s about enabling smart, calculated risks, not just policing past mistakes.

In this guide, we’ll get into the real differences between internal audit and ERM, map out the rewarding risk management career path for CA professionals, and show you what it takes to make the switch.

What is internal audit?

Internal audit is an independent, objective function focused on assurance and consulting. The whole point, as the Institute of Internal Auditors explains, is to add value and improve a company’s operations.

Think of it as the “third line of defense.” The first line is the business unit handling its own risks, and the second is a function like ERM providing oversight. Internal audit is the third line, giving the board and the audit committee confidence that everything is working the way it should.

This role is almost entirely detective work. You’re digging into historical data, testing transactions that already happened, and making sure the company is compliant with regulations like SOX. The big question you’re always answering is, “Did we do things right?”

It’s a vital role for good governance and keeping the company out of hot water. But its focus is firmly on the past, and reporting usually goes straight to the Audit Committee, keeping it very compliance-oriented.

What is enterprise risk management?

Enterprise Risk Management, or ERM, is a different animal altogether. It’s a structured, ongoing process for spotting, assessing, and responding to all the opportunities and threats that could affect a company’s goals.

ERM acts as the “second line of defense.” Instead of waiting for things to break, risk managers work alongside business leaders to get ahead of potential issues. They aren’t auditors; they’re partners.

This makes the role naturally preventive. ERM pros look at the whole risk landscape, including strategic, financial, operational, and even reputational, all before anything bad happens. Their work helps the C-suite avoid unpleasant surprises and make better, more informed decisions. It’s not just about stopping losses; it’s about giving the organization the confidence to take the right risks to grow. The question ERM is always asking is, “Are we doing the right things to succeed in the future?”

This strategic focus is what makes ERM so powerful. You’re not just reviewing old reports; you’re shaping future strategy. This often means you have a direct line to the Risk Committee, the CEO, and even the Board of Directors, giving you a level of visibility that’s hard to find in more traditional accounting roles.

ERM vs internal audit

While both roles deal with “risk,” they approach it from completely different angles. Their scope, mindset, and business impact couldn’t be more distinct. In fact, internal audit is often responsible for providing assurance on the ERM process, which is a big reason why they should be separate functions. This separation helps avoid any conflicts of interest. To make the distinction even clearer, let’s look at a visual breakdown of how these roles compare.

Let’s break down what really separates these two career paths.

Key career differences: Salary, growth, and boardroom access

When you get right down to it, the differences in day-to-day work lead to huge differences in career trajectory.

First, let’s talk about money. The financial upside in ERM is pretty big. According to Zippia, the average salary for a risk manager in the U.S. is $116,072. Compare that to an internal auditor, who earns an average of $63,013. That’s a compelling gap.

But it’s not just about the starting pay. The career growth outlook is also worlds apart. Job growth is projected at a healthy 17% for risk managers, versus just 6% for internal auditors. The demand for strategic, forward-looking thinkers is clearly growing.

The “why” behind these numbers is all about visibility and impact. This is the boardroom access part. Internal Audit usually reports to the Audit Committee, where conversations are about compliance and past performance. ERM, on the other hand, reports to the Risk Committee and senior leadership. The discussions are about future strategy, competitive threats, and the company’s appetite for risk. For a CA, this means you get a seat at the strategic table much earlier in your career.

Key differences between

| Feature | Internal Audit | Enterprise Risk Management (ERM) |

|---|---|---|

| Primary Focus | Historical & Compliance-focused | Forward-looking & Strategy-focused |

| Mindset | Detective (What went wrong?) | Preventive (What could go wrong?) |

| Line of Defense | Third Line (Independent Assurance) | Second Line (Management & Oversight) |

| Reporting Line | Primarily to the Audit Committee | To the Risk Committee, CEO, and Board |

| Average US Salary | ~$63,013 | ~$116,072 |

| Value Proposition | Provides assurance on controls. | Enables informed, calculated risk-taking. |

Create an ATS-friendly resume with our Resume Builder.

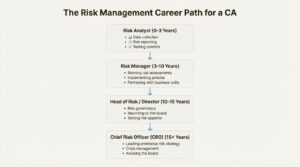

Risk management path for a CA

The great news is that the analytical skills you’ve honed as a CA are the perfect foundation for a risk management career path. The journey is less about rigid titles and more about growing your responsibility and strategic influence. Here’s a general idea of what it looks like.

Entry-level: Risk analyst (0–3 years)

This is where you’ll earn your stripes. As a risk analyst, your world will be data collection, analysis, risk reporting, and testing controls. It’s all about building your technical foundation.

You’ll be helping senior team members, maintaining risk registers (the master list of all potential risks), drafting reports, and getting used to risk management systems. You’ll also get your first real exposure to industry frameworks like COSO or ISO 31000.

Mid-level: Risk manager (3–10 years)

Once you have the basics down, you’ll move into a risk manager role. Here, the focus shifts from just analyzing data to running full risk assessments, working with people across the business, and helping to implement risk policies.

This is where you start taking ownership. You might be responsible for the risk assessments of an entire business unit, contribute to scenario planning, and work directly with business partners to help them understand and use the company’s risk framework in their daily decisions.

Senior-level: Head of risk / Director (10–15 years)

At the senior level, your focus gets much broader. It’s all about risk governance, reporting to the board, and making sure the company’s risk strategy lines up with its business goals.

Your responsibilities will include helping set the organization’s overall risk appetite (how much risk it’s willing to take), overseeing internal control programs, talking with regulators, and influencing the most senior leaders in the company. This role requires sharp business acumen and the confidence to hold your own in the boardroom.

C-suite: Chief risk officer (CRO) (15+ years)

You’ve made it to the top. The Chief Risk Officer (CRO) is a key member of the C-suite, leading the entire risk agenda for the organization. This is a top-down executive role focused on enterprise risk strategy, crisis management, and advising the board.

The CRO makes sure the company’s risk management framework is solid, effective, and supports the overall business objectives. It’s a high-stakes, high-reward position that sits at the crossroads of strategy, finance, and operations. The compensation reflects that, with the average salary for a CRO in the US around $279,311.

Key skills and qualifications

Making the jump from audit to ERM isn’t just about learning new technical skills. It’s about developing a more strategic, business-focused mindset to go with the analytical rigor you already have as a CA.

Here are some of the key things you’ll need:

- Strong Analytical and Quantitative Skills: This one’s a given. You need to be able to dive into complex data, build models for potential outcomes, and assign numbers to different types of risk.

- Excellent Communication: This is non-negotiable. You’ll have to explain complex risk concepts to people who aren’t specialists, from front-line managers all the way up to the board of directors.

- Strategic Thinking: You have to see the big picture. The best risk professionals can connect seemingly unrelated risks from different parts of the business and understand how they could impact the company’s main goals.

- Stakeholder Influence: It’s one thing to spot a risk; it’s another to convince a business leader to spend time and money to deal with it. You need the ability to negotiate, persuade, and build consensus.

Valuable professional certifications for ERM

While your CA qualification is a fantastic start, a few other certifications can really speed up your ERM career.

- Financial Risk Manager (FRM): This is the big one for financial risk. According to GARP, the governing body, the FRM is comparable to a Master’s degree in terms of difficulty. It’s recognized globally as the gold standard and requires passing two tough exams and having two years of relevant work experience.

- Chartered Financial Analyst (CFA): While broader than the FRM, the CFA designation is great for anyone looking to specialize in market and investment risk. It gives you a deep understanding of finance and portfolio management, but be ready for a marathon, as it typically takes around three years to complete.

- Certified Information Systems Auditor (CISA): With cybersecurity risk becoming a top concern for every board, the CISA is the top certification for CAs who want to specialize in IT risk. Over 151,000 professionals hold this certification globally, making it a highly respected credential in a fast-growing field.

From scorekeeper to strategist

For any CA in traditional audit who wants a more dynamic and influential role, the risk management career path offers a seriously rewarding alternative.

It’s a complete shift in perspective. You move from being a backward-looking “detective” who catalogs past mistakes to a forward-looking “preventive” strategist who helps senior leaders navigate a safer and more successful future.

The benefits we’ve talked about aren’t just ideas. They are real, measurable advantages: much higher earning potential, a stronger job growth outlook, and the kind of boardroom access that can take decades to achieve in other roles. If you’re ready to trade checklists for strategy sessions, ERM might just be the perfect next move for your career.

Ready to transition from a traditional CA role to a strategic risk advisor? Explore our resources to build the skills you need for a successful career in Internal Audit.

Also read: Investment Banking vs Corporate Finance in India: Salary, Roles & Careers

Frequently Asked Questions

Q.1 What is the first step in a risk management career path for CA?

A: The typical first step is an entry-level role like a Risk Analyst. This is where you’ll learn the fundamentals, from data analysis and control testing to maintaining risk registers, building a solid foundation for your career.

Q.2 How does the salary in a risk management career path for CA compare to internal audit?

A: The earning potential is substantially higher. On average, a risk manager in the U.S. earns around $116,072, which is significantly more than the average internal auditor salary of about $63,013.

Q.3 What certifications are most valuable for a risk management career path for CA?

A: While your CA qualification is a great start, certifications like the Financial Risk Manager (FRM), Chartered Financial Analyst (CFA), or Certified Information Systems Auditor (CISA) can significantly boost your risk management career path for CA.

Q.4 Is a risk management career path for CA more strategic than traditional accounting roles?

A: Absolutely. This career path is inherently forward-looking and strategic. Instead of reviewing past transactions (like in audit), you’ll be working with leadership to identify and manage future risks and opportunities, directly influencing business strategy.

Q.5 What does the long-term progression of a risk management career path for CA look like?

A: The progression is quite clear. You typically start as a Risk Analyst, move up to Risk Manager, then to a senior role like Head of Risk or Director, with the ultimate goal being the C-suite position of Chief Risk Officer (CRO).

Q.6 Why is ERM considered a good risk management career path for CA?

A: ERM is an excellent path because it shifts your focus from compliance to strategy. It offers higher earning potential, better job growth prospects, and gives you direct access to senior leadership and the boardroom much earlier in your career.