Interview Questions in Forensic Audit You Must Prepare For (With Answers)

Introduction

With fraud risks rising and regulatory scrutiny tightening, forensic audit roles are in high demand—especially across consulting firms, banks, and regulatory bodies. But cracking a forensic audit interview requires more than just textbook knowledge. You need a solid grip on real-world applications, logical reasoning, and the ability to think like an investigator.

In this blog, we’ve curated a list of must-know forensic audit interview questions, along with crisp and confident answers to help you stand out. Whether you’re a fresher, a CA aspirant, or a finance professional looking to pivot into forensic services—this guide will get you interview-ready in no time.

Forensic Audit Interview Questions & Answers

Ques 1: Please summarize the important learning you have gained in Forensic Audit?

- Fraud occurs as a result of the interplay between 3 factors: opportunity, incentive or pressure, and

attitude or rationalisation. - The Sarbanes Oxley Act is the direct result of numerous high-profile fraud cases.

- Responsibilities to detect fraud is not only in the auditor’s but also the company’s.

- Forensic auditing allows auditors to retrieve deleted data and files.

- The IT auditor should be aware of the various type of tools to retrieve and analyze evidence.

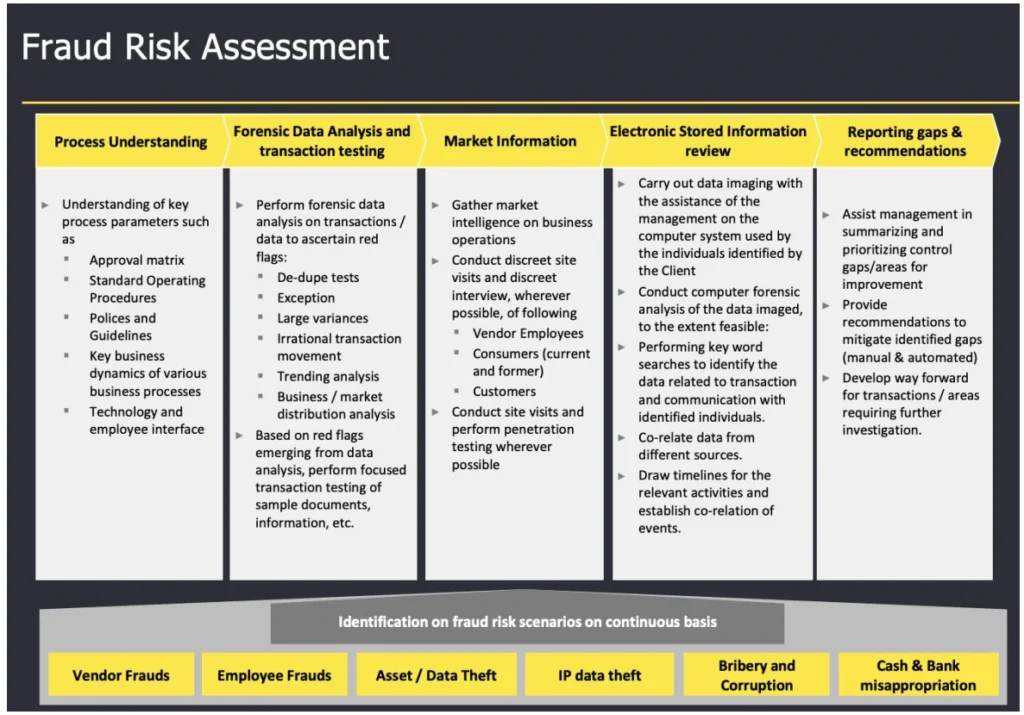

Ques 2: Can you please tell me what fraud risk assessment is & explain its steps?

Ques 3: How are situations handled where financial data is incomplete or unavailable?

When faced with incomplete or unavailable financial data:

- Seek Alternative Sources: Obtain information from backup systems, third-party records, or related documents.

- Conduct Interviews: Gather insights from relevant personnel to fill in gaps.

- Use Analytical Procedures: Apply estimation techniques and reasonableness tests based on available data.

- Document Assumptions: Clearly record any assumptions made during the analysis to maintain transparency.

Ques 4: How do you handle situations where your forensic audit findings implicate senior management in fraudulent activities?

Handling such situations requires:

- Objectivity: Maintaining impartiality and focusing on factual evidence without bias.

- Confidentiality: Ensuring findings are disclosed only to authorized individuals to prevent undue harm or retaliation.

- Reporting Protocols: Following established protocols for reporting findings, which may involve informing the audit committee or board of directors.

- Legal Consultation: Engaging legal counsel to navigate potential legal implications and to ensure compliance with regulatory requirements.

- Documentation: Thoroughly documenting all findings, evidence, and communications to support the investigation’s integrity and any subsequent actions.

Ques 5: Give some red flags for Shell Companies?

Red flags for Shell companies:

- No physical office, no website or staff.

- Common addresses/directors with employee/management.

- Frequent use but limited scope or output.

- No GST filings, minimal banking activity.

- Often created just before the transaction and closed soon after

Ques 6: What is the difference between an Internal Audit & Forensic Audit?

Aspect | Internal Audit | Forensic Audit |

Objective | To evaluate internal controls, risk management, and compliance. | To investigate suspected fraud, financial misconduct, or legal violations. |

Nature | Preventive and regular (periodic reviews) | Investigative and reactive (triggered by suspicion or incident). |

Scope | Broad – covers operational, financial, and compliance areas. | Narrow – focused on specific fraud, irregularities, or disputes. |

Users of Report | Management, audit committee, board of directors. | Legal teams, law enforcement, courts, regulatory bodies. |

Initiated By | Management or audit committee. | Legal department, regulators, law enforcement, or external authorities. |

Reporting | Periodic reports to management with suggestions for improvement. | Detailed report with findings, evidence, and sometimes legal opinions. |

Legal Admissibility | Not usually designed for legal proceedings. | Designed to be admissible in court; must follow evidence protocols. |

Evidence Collection | General observation, testing, and inquiry. | Formal methods – chain of custody, digital forensics, documentation. |

Tools Used | Audit sampling, control testing, walkthroughs. | Data analytics, digital forensics, link analysis, surveillance. |

Employee Interaction | Focus on process walkthroughs and interviews. | May involve interrogations or background/lifestyle checks. |

Frequency | Ongoing or scheduled regularly (monthly, quarterly, annually). | Conducted only when needed or when fraud is suspected. |

Output | Recommendations for improvement and risk mitigation. | Factual findings and evidence to support legal or disciplinary action. |

Skills Required | Auditing standards, risk assessment, compliance. | Fraud investigation, forensic accounting, digital forensics, legal knowledge. |

Confidentiality | Reports usually shared within management. | Highly confidential, often shared only with legal/official authorities. |

End Result | Process improvement, enhanced controls. | Legal action, disciplinary action, prosecution, or recovery. |

Ques 7: What are proactive forensic techniques companies can implement to prevent fraud?

- Continuous transaction monitoring

- Data analytics on high-risk areas (e.g., procurement, payroll)

- Fraud risk assessments annually

- Whistleblower mechanisms

- Mandatory leave/rotation for key finance roles

- Surprise audits and forensic readiness reviews

Ques 8: How do you trace fraudulent journal entries in ERP systems like SAP/Oracle?

- Use T-code or audit trail logs to see who created/modified entries.

- Filter manual journal entries bypassing standard approval workflow.

- Look for “suspense”, “adjustment”, “other charges” accounts.

- Check if entries were made during weekends, holidays, or outside office hours.

Ques 9: How would you perform a forensic review of a loan book in a Non-Banking Financial Company (NBFC)?

- Identify related-party borrowers by matching PANs, mobile numbers, or common directors.

- Analyze loan disbursement vs. usage trail — ensure funds reached intended party.

- Watch for back-to-back lending or circular fund flows.

- Validate documentation: KYC, credit appraisals, and repayment capacity.

- Focus on loans disbursed just before year-end or with weak collateral.

Ques 10: Please explain the concept of “tracing” in forensic accounting and provide an

example?

In forensic accounting, “tracing” refers to following the movement of funds or assets to determine their origin or destination. For example, if an employee is suspected of embezzling funds, tracing involves analyzing financial records to track the flow of money through various accounts to identify where the funds were diverted.

Practice for your Forensic Audit Interview with our new AI Interview Bot.

Conclusion

Forensic audit interviews are not just about knowing definitions—they test your mindset, analytical thinking, and ability to connect the dots in complex situations. By preparing with these key questions and answers, you’re not just revising concepts—you’re building the confidence to think like a forensic expert.

Whether you’re aiming for Big 4 roles, internal audit teams, or specialised forensic divisions, remember: clarity, logic, and presence of mind are your biggest assets. Keep practising, stay curious, and walk into that interview ready to decode fraud like a pro.

Join our Forensic Audit Masterclass and elevate your investigative skill

Are you a Nov 24 Qualified CA?

Join the exclusive WhatsApp group to learn, network, and win together!