GST Audit Types Explained: Section 65, 66 & GSTR-9C

The landscape of GST compliance has shifted beyond straightforward, turnover-based checks. If you’re a Chartered Accountant or tax practitioner, you have likely observed that clients are receiving an increasing number of notices from the GST department. These notices are more frequent and often pertain to more than just routine checks. The real challenge now is dealing with audits initiated by the tax authorities themselves.

You have mastered return filing, but now you must defend your clients when the department conducts an audit. This guide is designed to help with that process. We will cover the main GST audit types, focusing on the differences between a full departmental audit under Section 65 and the self-certified GSTR-9C reconciliation statement.

Your role is evolving from a compliance checker to an advisor and advocate. This guide will help you transition from being a back-office expert to a front-line representative for your clients.

What is a GST audit?

A GST audit, as defined by Section 2(13) of the CGST Act, is an examination of a business’s records, returns, and other financial documents.

The main goal is to ensure everything adds up: the turnover declared, taxes paid, refunds claimed, and Input Tax Credit (ITC) taken. It is the department’s method for verifying that businesses are complying with the rules in the GST self-assessment system. Because self-assessment can lead to errors, audits are the primary way authorities identify and rectify any issues.

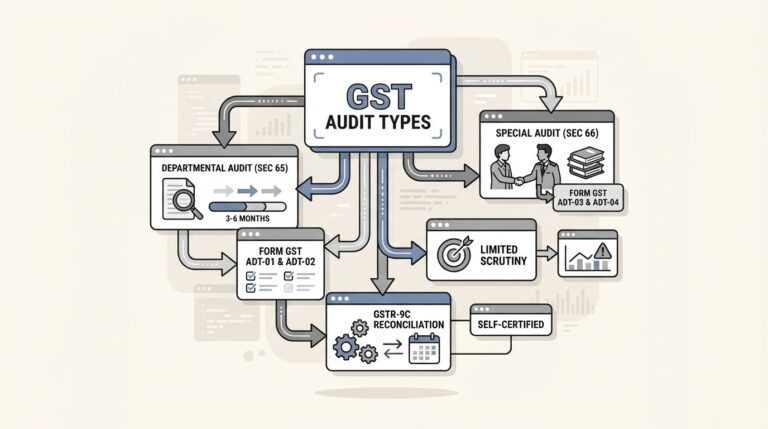

Understanding the primary GST audit types

When it comes to GST audits, there are two main types you will encounter. While both aim for compliance, their origins, procedures, and potential outcomes for clients differ significantly. Let’s get into the details.

What is the GSTR-9C self-certified reconciliation statement?

A formal audit, certified by a CA or CMA, was previously required for businesses with a turnover over ₹2 crores under Section 35(5) of the CGST Act.

However, the Finance Act of 2021 introduced significant changes, and from the financial year 2020-21 onwards, third-party certification is no longer needed.

Currently, businesses with an annual aggregate turnover of more than ₹5 crores must file a self-certified GSTR-9C. The key term here is “self-certified.” The responsibility now rests entirely on the taxpayer. The main purpose of GSTR-9C is to ensure the figures in the annual return (GSTR-9) align perfectly with the company’s audited financial statements. It is a check to ensure the tax department receives numbers consistent with the official books.

Departmental audit (Section 65)

A departmental audit can be a significant event for a business. It is carried out directly by GST authorities, such as the Commissioner or an authorized officer. Their objective goes beyond just matching numbers; they are checking for overall compliance and looking for any indication of incorrect tax payments or evasion.

Typically, your client receives a formal notice in FORM GST ADT-01 at least 15 working days before the audit. The audit usually takes place at the business premises, but can sometimes be at the department’s office.

Once the audit begins, the department has three months to complete it, with a possible six-month extension from the Commissioner. After it is done, the findings are given to your client in FORM GST ADT-02 within 30 days. If the audit uncovers issues, like wrongly claimed ITC or underpaid taxes, the authorities can start recovery proceedings under Section 73 (for non-fraud) or Section 74 (for fraud).

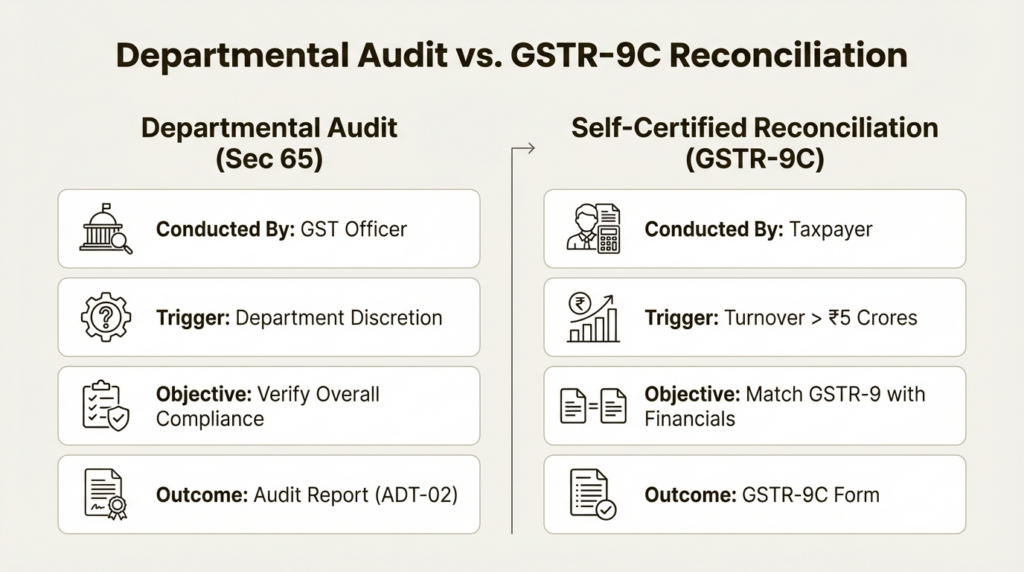

Comparing departmental audits and GSTR-9

| Feature | Departmental Audit (Section 65) | Self-Certified Reconciliation (GSTR-9C) |

|---|---|---|

| Conducted By | Commissioner or authorized GST officer | Taxpayer (self-certified) |

| Trigger | Based on departmental risk parameters | Turnover exceeding ₹5 crores |

| Legal Section | Section 65, CGST Act 2017 | Section 44, CGST Act (amended) |

| Timeline | 3 months (extendable by 6 months) | Filed annually with GSTR-9 |

| Key Objective | Check GST compliance & detect short payment | Match GSTR-9 with audited financials |

| Outcome | FORM GST ADT-02 audit report | Self-certified Form GSTR-9C |

Handling different GST audit types

Since GSTR-9C is now self-certified, the role of a CA has changed. The focus has shifted from routine certification to defending clients during departmental audits, which can have significant financial implications. This is where you can act as a key advisor and front-line representative.

Decoding the departmental audit notice (FORM GST ADT-01)

When a client receives a FORM GST ADT-01, a structured approach is necessary. The first step is to carefully review the notice for key details: the audit period, the specific documents requested, the official start date, and whether your client received the required 15-working-day notice.

Your initial actions should be to acknowledge the notice, explain the situation clearly to your client, and begin methodically collecting all the requested information. How you handle this first step can influence the entire audit.

Check out our masterclass on Statutory Audit.

Pre-audit health check: A preventative checklist

Proactive preparation is the most effective strategy for managing an audit. Offering a “pre-audit health check” is a valuable service for your clients. It helps you identify potential problems before the department does. This can be considered a preventative review of their financial compliance.

Here’s a checklist you can use for a detailed review:

Master your reconciliations: This is absolutely critical. Make sure the data in GSTR-3B, GSTR-1, and the auto-populated GSTR-2B all match up for the entire audit period. Any mismatch is an easy find for an auditor and a definite red flag.

Verify your ITC: Dig into the Input Tax Credit claims. Check every major claim to confirm it is eligible. Do you have the right tax invoices? Can you prove the goods or services were received? And do not forget to check for required reversals, like if a supplier was not paid within 180 days.

Analyze e-way bills: Logistics matter. Compare the e-way bill data with sales invoices and the numbers in GSTR-1. The values, descriptions, and quantities should all match. Unexplained differences could suggest undeclared sales.

Check your Reverse Charge Mechanism (RCM) compliance: RCM is a frequent source of mistakes. Confirm your client has paid tax under reverse charge for all relevant services, like from a Goods Transport Agency (GTA) or for legal fees. It is also important to ensure the related ITC was claimed correctly in the next month.

Review classification and tax rates: Look at your client’s main products or services. Are the HSN codes right? Are the GST rates correct? A small classification mistake can lead to a big tax shortfall over time, which will only grow with interest and penalties.

Preparing a robust response: From documentation to representation

After you have done your prep work, it is time to build your case. A well-organized and professional response is crucial. It indicates to the officer that you are prepared, transparent, and cooperative.

Start by gathering all requested documents into one, neatly indexed file. Do not just hand over a stack of papers. Include a cover letter listing every document. It is also a good idea to prepare a formal written submission that addresses any potential issues you found during your health check. If you found a reconciliation difference with a good explanation, lay it out clearly with supporting proof.

Other important GST audit types

Departmental audits and GSTR-9C are the most common, but there are a couple of other GST audit types you should know about to give your clients the full picture.

Special audit (Section 66)

A special audit involves the appointment of an external expert by the department. An officer (Assistant Commissioner or higher) can call for one if a case seems especially complex. This might happen if they question the valuation of goods or services, or if the ITC claimed seems unusually high.

Instead of doing the audit in-house, the Commissioner appoints a practising CA or CMA for the job. The official order comes in Form GST ADT-03. This professional then performs a detailed audit and reports their findings in Form GST ADT-04. They get 90 days to finish, with a possible 90-day extension. The good news for your client is that the cost of this audit is covered by the commissioner, not the taxpayer.

Limited scrutiny: A focused check

Limited scrutiny is a targeted inquiry rather than a full audit. It is often triggered automatically by the GST system’s risk-detection tools, which might flag a specific issue. A common trigger is a mismatch between the turnover in GSTR-1 and the tax paid in GSTR-3B.

The tax officer will send a notice asking for an explanation and documents related to that one issue. While it is not as extensive as a Section 65 audit, it should be taken seriously. If a satisfactory explanation for the discrepancy cannot be provided, it could lead to a tax demand.

Developing skills for modern GST audits

The evolving GST landscape requires CAs to develop new skills. Managing tax litigation is becoming a core competency for any successful practitioner.

Consider how skills like ‘GST Notice Drafting,’ ‘Departmental Audit Representation,’ and ‘Handling Section 73/74 Proceedings’ would enhance a professional resume. These are the capabilities clients need and value highly. It is an opportunity to level up and position yourself as a litigation expert, not just a compliance specialist.

Staying prepared and compliant

Knowing the different GST audit types is crucial in today’s tax climate. The focus has moved from simple certification to actively defending clients in departmental audits.

A proactive strategy can distinguish between a smooth audit process and one with costly consequences. As a CA, your role is more important than ever. You are a year-round advisor and defender, not just a compliance checker. By staying on top of these changes, you can shield your clients from penalties and prove yourself as their go-to expert.

Check out our masterclass on Indirect Tax.

Also read: The 5 best AI tools for CA practice in 2026

Frequently Asked Questions

Q.1 What are the main GST audit types a CA should be aware of?

A: The primary GST audit types include the departmental audit under Section 65, the special audit under Section 66, and limited scrutiny. While no longer a formal audit, CAs must also handle the self-certified GSTR-9C reconciliation statement, as it is often a precursor to departmental scrutiny.

Q.2 How have GST audit types evolved for businesses in recent years?

A: The biggest change is the shift away from mandatory statutory audits certified by a CA (previously under Section 35(5)). Now, businesses with turnover above ₹5 crores file a self-certified GSTR-9C. This has increased the frequency and importance of departmental GST audit types, where the tax authorities directly examine a taxpayer’s records.

Q.3 Which of the GST audit types is the most serious for a taxpayer?

A: A departmental audit under Section 65 is generally considered the most comprehensive and serious. It involves a thorough examination of all records and can result in significant tax demands, interest and penalties under Section 73 or 74 if discrepancies are found. A special audit under Section 66 is also serious due to its complexity.

Q.4 What triggers the different GST audit types?

A: A departmental audit is initiated at the discretion of the tax authorities based on risk analysis. A special audit is ordered for complex cases, often involving valuation or ITC issues. Limited scrutiny is usually triggered automatically by the GSTN system flagging mismatches, like differences between GSTR-1 and GSTR-3B.

Q.5 What is a CA’s primary role when a client faces one of these GST audit types?

A: A CA’s role has shifted from a compliance checker to a defense representative. When a client faces an audit, the CA’s job is to decode the notice, help gather all necessary documentation, identify and explain potential issues proactively, and represent the client before the tax authorities to ensure a smooth and fair process.

Q.6 Can a taxpayer be subjected to multiple GST audit types for the same period?

A: Yes, it is possible. For example, a business might undergo a limited scrutiny for a specific mismatch, and the findings from that could lead the department to initiate a more comprehensive departmental audit under Section 65 for the same tax period if they suspect larger issues.