FP&A vs consulting: Which path is right for your finance career?

So, you’ve done the hard work. You’ve passed your exams, logged countless hours in Excel, and now you’re at a classic fork in the road. It’s a question every ambitious finance pro asks: do I build a company’s financial future from the inside, or do I solve its biggest problems from the outside?

This is the core of the FP&A vs consulting debate.

Let’s be clear, this isn’t a choice between a “good” and “bad” career. It’s a choice between two very different ways of thinking and living. Are you the internal architect, carefully designing and maintaining the financial blueprint of one company for the long haul? Or are you the external strategist, parachuting in to solve critical, high-stakes problems for many different companies?

This guide is here to cut through the noise. We’ll use real-world data and experiences to break down what each path actually looks like day-to-day, helping you match your career with your personality and what you really want out of life.

What does an FP&A role involve?

Forget the textbook definition for a moment. Think of Financial Planning & Analysis (FP&A) as the strategic engine of a company. Accounting looks backward and tells you what happened. FP&A looks forward and advises on what should happen next. You’re the one building the financial roadmap for the future.

What does that actually mean?

Your work has a certain rhythm. It follows a predictable cycle: you’re deep in annual budgeting, then you shift to quarterly forecasting, and every month, you’re running variance analysis to see how the actual numbers compared to your plan. It’s structured, and you become an expert on the company’s financial calendar.

But it’s not just about crunching numbers alone in a corner. A massive part of the job is business partnering. You’re not just a “finance person”; you’re a trusted advisor to department heads. You build long-term relationships, helping the marketing lead understand their campaign ROI or working with the operations team to model the cost of a new supply chain. You’re the in-house expert, turning raw financial data into a story that shapes real business decisions. To do well here, you need more than just technical chops; you need to be a great communicator and a reliable partner.

What does a consulting role involve?

If FP&A is the steady hand guiding the ship, consulting is the special forces team called in for a critical mission. It’s a high-stakes, project-based world where you become an expert problem-solver for a whole roster of different clients. One month you might be developing a market-entry strategy for a tech company in Southeast Asia; the next, you’re guiding a manufacturing giant through a complex merger.

The day-to-day is anything but predictable. The environment is fast, and every new project is a new puzzle with a very tight deadline. You’re usually staffed on one intense project at a time, which allows for an incredible depth of focus. You live and breathe that client’s problem until you’ve cracked it.

Unlike the repeatable processes in FP&A, consulting thrives on ambiguity. As one consultant from Bain put it, you’re often “inventing a lot of these analyses on the fly.” That’s the whole idea, if there were a simple, cookie-cutter solution, the company would have figured it out themselves. They hire you to solve the unsolvable. Success depends on your ability to form a hypothesis, test it with a mix of hard data and qualitative insights (from things like expert interviews), and package your findings into a solid, data-driven recommendation. It’s about finding the signal in the noise and presenting it with total conviction.

A head-to-head comparison: FP&A vs. consulting

Now that we have a feel for the roles, let’s put them side-by-side. The differences go beyond daily tasks and shape your entire professional life, from your paycheck to your work-life balance.

The nature of the work

In FP&A, you are an internal owner. Your work is structured and follows a cyclical rhythm, all focused on building deep institutional knowledge. The goal is to sustain and optimize one business from the inside. You get to see the long-term impact of your forecasts and recommendations, watching them play out over years, not just months. It’s a marathon.

In Consulting, you are an external advisor. The work is dynamic, project-based, and built on seeing patterns across different companies and industries. The mindset is about quickly diagnosing a problem, recommending a solution, and then moving on to the next challenge. You gain an incredible breadth of experience, but you often don’t stick around to see your recommendations fully implemented. It’s a series of sprints.

Career progression and compensation

The career path in FP&A is usually stable and predictable. You move up a clear ladder: Analyst to Senior Analyst, then Manager, and eventually Director or VP of Finance. It’s a well-worn path to the C-suite, with a reported 47% of CFOs having prior FP&A experience. In terms of salary, an FP&A Manager in a major market can expect to earn somewhere in the $85,000 to $115,000 range.

Consulting, on the other hand, is known for its rapid, “up or out” culture. The expectation is that you’re constantly learning and advancing, and if you’re not, you’re gently pushed toward the exit. This intensity comes with a big reward. Some professionals report advancing at twice the pace of their industry peers. The pay reflects this; a mid-level Consultant can earn between $140,000 and $245,000, a major jump from a similar FP&A role.

Work-life balance

This is often the deciding factor for a lot of people. FP&A generally offers a much better and more predictable work-life balance. A typical week might be around 45-55 hours. Of course, it’s not always easy. During peak seasons like the annual budget cycle, you can expect those hours to climb up to 70. But these peaks are predictable.

Consulting is famously demanding. Work weeks of 70-100 hours are not unusual when you’re on a tight project deadline. While many firms have tried to protect weekends, the intensity of the week is real. Another key lifestyle factor is travel. It’s very common to be on a plane Monday morning and fly back home Thursday night, every single week for the length of a project. For some, that’s an exciting adventure; for others, it’s a dealbreaker.

| Feature | Financial Planning & Analysis (FP&A) | Management Consulting |

|---|---|---|

| Primary Role | Internal financial architect & business partner | External problem-solver & strategic advisor |

| Work Style | Cyclical & structured (monthly, quarterly, annual) | Project-based & dynamic (weeks to months) |

| Pace & Hours | Steady (45-55 hrs/week) with predictable peaks | Fast-paced & intense (70-100 hrs/week) |

| Data Focus | Hard financial data and internal metrics | Mix of quantitative & qualitative data |

| Key Challenge | Influencing internal stakeholders, process ownership | High ambiguity, tight deadlines, client management |

| Career Path | Stable progression (Analyst > Manager > Director > CFO) | Rapid “up or out” (Analyst > Consultant > Partner) |

| Typical Lifestyle | More predictable schedule, less travel | Demanding hours, frequent weekly travel |

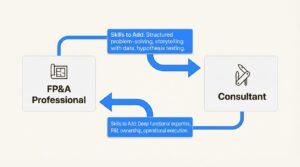

Career transitions between FP&A and consulting

Here’s the good news: your first choice doesn’t have to be your last. People move between these fields all the time, and the skills you gain in one are incredibly valuable in the other. Here’s a look at how those transitions work.

Moving from FP&A to consulting

This is a common move for high-performing FP&A professionals who want to speed up their career or get broader experience. Your strong financial modeling skills, business sense, and deep understanding of how a company actually operates are gold to consulting firms.

The biggest gap you’ll need to fill is getting comfortable with ambiguity and qualitative analysis. In consulting, you won’t always have perfect data. You’ll need to master structured problem-solving (think frameworks and hypothesis trees) and learn how to build a compelling story with PowerPoint. To get a head start, an industry-focused program like the Consulting Masterclass can be a huge help. It’s designed to give you the exact case-solving frameworks that top firms like McKinsey, BCG, and Bain use in their interviews.

Moving from consulting to FP&A

This is often a strategic move for consultants looking for a better work-life balance or the chance to truly “own” a P&L and see their strategies through. You bring a powerful toolkit: a top-down strategic mindset, top-tier project management skills, and the ability to explain complex ideas clearly to senior leadership.

The biggest adjustment is shifting from advising to doing. You’re no longer just making recommendations; you’re responsible for the day-to-day work and the long-term results. You’ll need to build deep, functional expertise in areas like financial systems and corporate governance. To hit the ground running, our FP&A Masterclass is designed to build that exact hands-on, practical knowledge you need to go from a high-level strategist to an effective internal leader.

A mentor’s take on the decision

Having mentored dozens of CAs and finance pros through this exact decision, here are a few things you won’t read in a standard career guide.

- “FP&A” is not one single thing. An FP&A role at a fast-growing startup can feel a lot like an internal strategy role, full of ambiguous projects and ad-hoc analysis. The same job title at a mature, stable public company might be 80% routine reporting and variance analysis. When you interview, you have to ask: “What’s the ratio of special projects to routine reporting in this role?” The answer will tell you everything.

- Choose your learning style: depth vs. breadth. This is the real question you should be asking. Do you get energized by becoming the world’s expert on your company’s supply chain costs (FP&A)? Or do you get excited by learning how five different industries tackle customer pricing in a single year (Consulting)? One builds incredible depth, the other builds incredible breadth. Neither is “better,” but one is definitely better for you.

- Your interview prep has to be different. You can’t use the same approach for both. FP&A interviews will grill you on your technical skills, financial modeling, and your grasp of accounting principles. Consulting interviews will focus almost entirely on your structured problem-solving through case studies. Your technical skills are just the entry ticket. Before you step into that high-pressure room, practicing your delivery with an Interview Bot can make all the difference, helping you refine your answers and build confidence for either scenario.

Making your decision

The choice in the FP&A vs consulting debate really comes down to one question: are you motivated by building and owning something from the inside, or by solving and advising from the outside? Both are incredibly rewarding paths that can lead you to the highest levels of business leadership.

There is no wrong answer here, only the answer that’s right for you, right now. The most successful professionals I know often have a “winding road” of experiences. They might start in FP&A, jump to consulting for a few years, and then return to the industry in a leadership role. Each step builds a unique and valuable set of skills.

So, what’s your next chapter?

Ready to build the practical, real-world skills for your chosen path? Explore our domain-specific Masterclasses at CA Monk and get the hands-on training that will help you not just land your dream role, but excel in it from day one.