A Beginner’s Guide to Financial Statements and How to Read them

What are Financial Statements?

Financial statements are the records of your business’s financial performance that determine the future course of your business. Based on your financial performance, you can make educated financial decisions for your company’s success.

There are a handful of activities that you can perform through your financial statements as an investor such as checking sales, identifying ‘break-even points’, calculating customer acquisition points etc.

In this blog, we will explore the detailed aspects of financial statements and will assist you in reading them with ease.

Functions of Financial Statements

Financial statements show how a business operates. They provide insight into how a business generates revenues, what those revenues are, what the cost of doing business is, how efficiently it manages its cash, and what its assets and liabilities are. These documents also show how well or poorly a company is managed.

Types of Financial Statements

Accounting uses three basic financial statements:

1. Balance sheet: The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It lists assets, liabilities, and equity.

2. Profit and loss statement: The profit and loss statement shows the company’s financial performance over a specific period, typically quarterly or annually.

3. Cash flow statement: The cash flow statement tracks the inflow and outflow of cash within a business over a period. It is divided into three sections.

3 Essential Elements of Balance Sheet

Assets: Assets state what valuable properties a company owns. It consists of various components like liquid assets, capital assets, etc. It can be categorised as long-term and short-term assets. These short-term assets are also known as current assets that can be converted into cash within 1 year or less. On the other hand, long-term assets can not be converted into cash.

Features of Short-Term Assets

- Cash or Equivalent of Cash: It includes treasury bills, hard currency, short-term deposit certificates, etc.

- AR or Accounts Receivable: AR refers to a customer’s money that is owed to the company.

- Inventory: It refers to the goods that are available for sale at lower market prices.

- Prepaid Expenses: Prepaid expenses represent the paid value that includes advertising contract, rent or insurance.

- Marketable Securities: It’s equity and debt securities.

Features of Long-Term Assets

Fixed assets and Intangible assets are known as long-term assets.

- Fixed Assets refers to land, machinery, equipment, etc.

- Intangible Assets refer to valuable intangible properties like intellectual properties and goodwill, etc.

Liabilities: Liabilities are the money that the company owes to any third parties. This can be in any form, such as due bills, bond interest, salaries, etc.

Equity: Shareholder’s Equity refers to the value that you get after subtracting total liabilities from total assets.

How to Read a Balance Sheet?

To calculate the value of your assets you can implement the simple formula:

Assets= Liabilities + Equity

Now follow the steps below to read the balance sheet easily:

Step 1: Look for the time at which balance sheets are made.

Step 2: Now calculate your assets based on that particular time. You have to add your current and noncurrent assets.

Step 3: Similarly, calculate your liabilities as well. This will give you the shareholder’s equity.

Step 4: Add total equity and liabilities and subtract or compare them with your total assets.

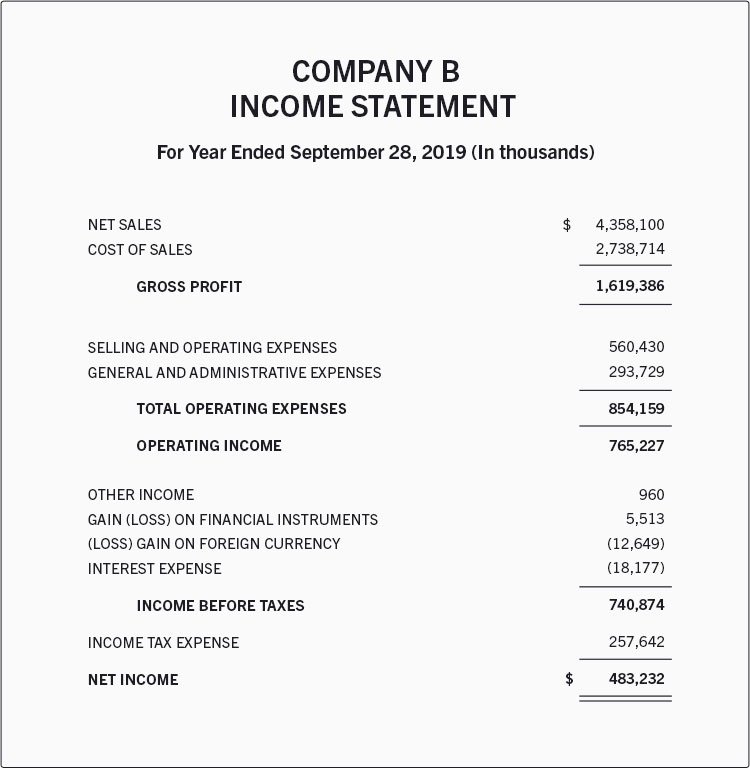

What Is an Income Statement?

An income statement, also referred to as a profit and loss (P&L) statement, summarizes the total impact of revenue, gain, expense, and loss transactions over a given period. The document is frequently distributed as part of quarterly and annual reports, and it displays financial trends, business activities (revenue and expenses), and comparisons over time.

Revenue

i) Operating Revenue is generated through selling the company’s products and services. So, it’s related to the core of business operations or activities.

ii) Non-Operating Revenue refers to the amount that is generated through a non-core business operation that involves renting properties, interest on cash, advertisement, etc.

iii) Other Income means the revenue you earn from the selling of long-term assets such as lands, subsidiaries, vehicles, etc.

How to Read an Income Statement?

- In the example shown above, Company B’s gross profit is $1,619, 306 which we get from comparing the cost of sales to total sales.

Gross Profit= Net Sales- Cost of Sales

- Similarly, Total Operating Income= Gross Profit-{ Selling and Operating Expenses + General and Administrative Expenses}

- You can calculate Income Before Tax in the following way

- Gross Profit – All operating expenses

- Income Before Tax – Interest expense

- Net income + Taxes

What is a Cash Flow Statement?

CFS or Cash Flow Statements enable the investors to develop an understanding of companies’ operations. It provides a detailed road map on how the company’s money is being spent and where the money is coming from. It has three sections a) operating activities b) investing activities c) financing activities

Operating Activities represent the value of the cash that is generated from product or service selling. Operating activities involve wage or salary payments to employees, receipts of saleable goods and services, income tax payments, interest payments, rent payments, etc.

Investing Activities refers to the value of cash that is being spent on investments. It includes purchasing or selling assets, payments during merging or acquisition, etc.

Financing Activities refer to transactions that involve equity, debt and dividends. For example, we can say that when a company issues its bond to the public, the cash or amount the company receives can be regarded as cash financing.

How to Read a Cash Flow Statement?

- In the cash flow statement, you will see the period in which the statement is made. At the same time just below that section, there will be another one where you can check the cash amount at the beginning of that period.

- Then there will be several subsections like cash from sales, cash spent on payroll, cash spent on expenses, interest paid on loans, GST and income tax under one main section called ‘ Cash Flow Operations.

- Now use this formula to calculate: Net Cash Flow From Operations = Cash from sales+Cash spent on payroll+Cash spent on expenses+Interest paid on loans+GST and Income tax.

- Further down you will see another main section named ‘Cash Flow From Investments’. There you will find subsections like sales of assets like vehicles, equipment, and purchase of assets.

- Now, calculate your Net Cash Flow from Investments Purchasing Assets -Selling Your Assets.

- Below You will find another section called “Cash Flow From Financing’. There you will see the owner’s contribution, repayments of loans, the owner’s drawings, etc.

- To calculate Net Cash Flow from Financing you will have to implement the formula: Net Cash Flow from Financing= (Repayments of Loans + Owner’s Drawings)- Owner’s Contribution

- For Net Cash Movement follow this formula: Net Cash Movement= (Net Cash Flow from Financing + Net Cash Flow from Investments)- Net Cash Flow From Operations

- In the final stage, you will get a summary of your opening balance, net cash movement, and closing balance.

5 Tips to Remember While Reading Financial Statements

- Develop a clear understanding of the fundamentals of financial statements.

- Always check the time frame.

- Don’t forget to check the past financial statement. It will give you a clear insight into the company’s current situation.

- Always read between the lines. The downward graph in profit margin or faster outflows of cash can pose serious problems.

- Focus on financial ratios like current ratio, and gross profit margin. It will make your analysis simplistic.

Conclusion

Assessing and comprehending these financial records can provide you with important insights into a company, including:

- Its debts and the capacity to repay them

- Profits and/or losses in a specific quarter or year

- Whether profit has increased or decreased compared to similar previous accounting periods.

- The amount of investment needed to keep or expand the business.

- Operational expenses, particularly in relation to the revenue generated by those expenses

Reading financial statements is a necessary skill for assessing a company’s financial health, whether you are an investor, business owner, or chartered accountant. Understanding the balance sheet, income statement, and cash flow statement provides valuable insights into a company’s assets, liabilities, profitability, and cash flow.

Need Help entering the Finance Domain?

Are you a Nov 24 Qualified CA?

Join the exclusive WhatsApp group to learn, network, and win together!