Algorithmic Trading Career for CA: A Practical Roadmap

If you’re a Chartered Accountant who loves the stock market, you’ve probably felt a certain disconnect. You see the world of high-frequency trading and quantitative funds, and it can feel like a club reserved for engineers and math PhDs from top universities. It’s easy to assume your expertise in IFRS and audit controls doesn’t quite fit into writing complex trading algorithms.

But that’s not the whole story. What if algorithmic trading is less about mind-bending calculus and more about simple, rule-based logic? At its core, an algorithm is just a set of “If this happens, then do that” instructions. That’s a way of thinking you already use every single day when testing financial controls or conducting an audit.

Now, the path is challenging. You won’t master it over a weekend. But it’s far from impossible, and there are real-world success stories of CAs who have made the switch. This guide is here to pull back the curtain on the process and give you a realistic roadmap. We’ll show you how your existing skills aren’t just relevant, they’re a powerful, often overlooked, asset for an algorithmic trading career for CA.

What is algorithmic trading?

Before we get into the weeds, let’s clarify what we’re talking about. Algorithmic trading (or algo trading) is simply using computer programs to execute trades based on a predefined set of rules. These rules can be based on timing, price, volume, or any mathematical model you can think of. The main goal is to spot profitable opportunities and manage risk without human emotion messing things up.

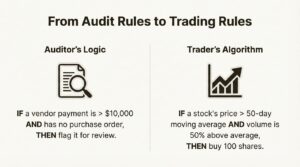

Think of it like this: when you’re auditing a company, you might have a rule that says, “If a vendor payment is over $10,000 and doesn’t have a corresponding purchase order, flag it for review.” An algo trading system does the same thing, but with market data. A rule might be, “If a stock’s price crosses above its 50-day moving average and trading volume is 50% higher than average, buy 100 shares.”

It’s all about automating a logical process. The computer isn’t “thinking”; it’s just following your instructions with incredible speed and discipline. Traders use this for all kinds of strategies, from simple momentum trading (buying assets that are trending up) to more complex statistical arbitrage (profiting from price differences between similar assets). The key takeaway is that it’s all about discipline and logic, a mindset that should feel very familiar to any CA.

The hidden advantage CAs bring to trading

This is where it gets interesting. Most people assume that software engineers have a massive head start, and while coding skills are essential (we’ll get to that), CAs bring a unique perspective that is incredibly valuable and often missing from purely technical teams.

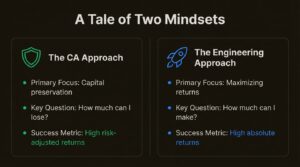

The risk management mindset: A key advantage

Engineers are often trained to optimize for a primary goal: maximizing returns. They excel at building systems designed to find the biggest, fastest, most profitable signal. While that’s important, a singular focus on returns can sometimes overlook tail risks: the low-probability, high-impact events that can wipe out an entire fund. In contrast, CAs are trained from day one in capital preservation, risk assessment, and understanding downside exposure. Your entire professional world revolves around the question, “What could go wrong here?” Since the 2008 financial crisis, this risk-first approach isn’t just a nice-to-have; it’s a critical part of any successful trading operation. A strategy that makes 50% but has a 20% chance of blowing up is far less attractive than one that makes a steady 15% with minimal drawdown. You instinctively get that.

| Mindset | Chartered Accountant Approach | Engineering Approach |

|---|---|---|

| Primary Focus | Capital preservation and consistent returns | Maximizing returns and optimizing speed |

| Focus | Managing downside risk and volatility | Finding the most profitable signal |

| Strategy Logic | “How much can I lose?” | “How much can I make?” |

| Success Metric | High risk-adjusted returns | High absolute returns |

A natural talent for rule-based logic

As we touched on earlier, the logic behind a trading algorithm is a lot like the work you do every day. The process of testing internal controls is a perfect example.

When you’re conducting an audit, your brain is running a constant series of logical checks: “IF the invoice is not approved by a manager, THEN flag it.” or “IF revenue is recognized before the service is delivered, THEN it’s a violation of accounting standards.”

This is the exact same thought process needed for creating a trading strategy. You’re just swapping business rules for market rules: “IF the 50-day moving average crosses above the 200-day moving average, THEN execute a buy order.” or “IF the stock’s volatility exceeds a certain threshold, THEN reduce position size.” You already know how to think in this structured, conditional way; you just need to learn how to translate it into code.

Understanding business fundamentals

Many quantitative traders, especially those from pure math or computer science backgrounds, operate exclusively in the world of price data. Their models are built on charts, patterns, and statistical relationships. While powerful, this approach can sometimes miss the bigger picture.

As a CA, you have a deep, intuitive understanding of what actually drives a company’s value. You can read a balance sheet, analyze cash flow statements, and assess the health of a business. This allows you to build more robust, hybrid trading strategies. You could, for example, design an algorithm that only looks for technical buy signals in stocks that also meet specific fundamental criteria, like a low price-to-earnings ratio or strong revenue growth. This ability to layer fundamental analysis on top of quantitative signals provides a distinct advantage and can lead to more robust hybrid strategies.

Bridging the essential skill gap

Okay, so you have the right mindset. Now for the hard part: bridging the gap between your current skills and what’s required in the quant world. It’s a steep learning curve, but if you focus on the right areas, it’s definitely manageable.

Mastering Python for finance

You need to learn to code, and in the world of quantitative finance, Python is king. It’s become the industry standard because it’s relatively easy to learn, versatile, and supported by a massive ecosystem of libraries that form the core toolkit for data analysis. You’ll need to get comfortable with a few key ones:

- Pandas: This is your workhorse for everything data-related. It makes it incredibly easy to import, clean, manipulate, and analyze financial time-series data (like stock prices or economic indicators).

- NumPy: The foundational library for numerical computing in Python. It allows for fast and efficient calculations on large arrays of data, which is essential for any kind of quantitative modeling. There’s also the modern numpy-financial package that contains dedicated financial functions.

- Matplotlib: You need to see what your data and strategies are doing, and Matplotlib is one of the most popular libraries for creating charts and visualizing your results.

Don’t worry, you don’t need to become a full-stack software engineer who can build a web application from scratch. You need to learn Python as a tool to implement your financial logic, test your ideas, and analyze the results.

Key quantitative concepts

While you might not need a PhD in astrophysics, a solid grasp of certain quantitative concepts is non-negotiable. The industry is competitive, and while you don’t need to be a Fields Medalist, you do need to speak the language. Many successful quants hold master’s degrees or have at least demonstrated a deep understanding of the underlying math. You should focus your studies on:

- Linear Algebra and Multivariate Calculus: This is the mathematical language that underpins most financial models. You need to understand concepts like matrices and derivatives to grasp how many quantitative strategies work.

- Probability Theory and Statistics: This is the bedrock of quantitative finance. You need to be extremely comfortable with concepts like probability distributions, standard deviation (risk), correlation, and a strategy’s expectancy (its average profit or loss per trade).

Understanding market microstructure

This is a topic that often gets overlooked by beginners, but it’s critically important in automated trading. Market microstructure is the study of how markets operate at a very granular level. It deals with the nitty-gritty details of how trades are actually executed, and ignoring it can turn a profitable strategy on paper into a money-losing one in reality. You’ll need to understand a few key terms:

- Order types: The difference between a market order (which says “buy or sell this right now at the best available price”) and a limit order (which says “buy or sell this only if you can get me this price or better”). Using the wrong one can cost you dearly.

- Liquidity: This is simply how easy it is to buy or sell an asset without affecting its price. Trading an illiquid stock is like trying to sell a house; it might take time and you might not get the price you want.

- Slippage: This is the difference between the price you expected to get on a trade and the price you actually got. In fast-moving markets, slippage can eat away at your profits, and you need to account for it in your models.

Create an ATS-friendly resume from our Resume Builder

Building algorithmic trading career as a CA

Once you start building your skills, the next step is to think strategically about how to make the career switch. It’s about more than just learning to code; it’s about positioning yourself correctly and understanding the landscape.

Setting realistic expectations

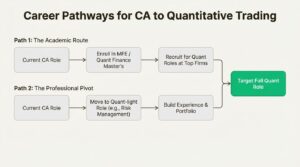

Let’s be direct: jumping straight from a senior auditor role at a Big Four firm to a quant strategist position at a top hedge fund is extremely rare. As some who have tried it have noted, it can feel like a “bridge too far.” You need to build credibility and experience first. Here are a couple of common, more realistic pathways:

- The Academic Route: This is the most traditional path. You enroll in a top-tier Master’s in Financial Engineering (MFE), Quantitative Finance, or a related program. This provides structured learning, a powerful network, and a credential that opens doors at major firms.

- The Professional Pivot: This involves making a series of strategic career moves. You might first move from audit into a more quantitative role within traditional finance, like equity research, portfolio management, or risk management. From there, having built a track record of quantitative work, you can more credibly target a full-blown quant role.

What roles can you target?

The term “quant” is broad. Based on real-world job postings, here are a few common entry points where a CA background could be a real asset:

- Quantitative Analyst: This is the classic “quant” role. You’ll spend your days researching, developing, and backtesting new trading strategies. Your job is to find signals and build the models that drive the firm’s trading.

- Algorithmic Trading Strategist: This is a specialized role focused more on the implementation and evaluation of trading logic. As seen in postings from firms like Alignerr, these roles often involve analyzing execution quality and market microstructure assumptions.

- Risk Quant: This is a fantastic and natural fit for CAs. In this role, you’re not necessarily developing new trading strategies, but you’re responsible for managing the risk of the firm’s entire portfolio. You’ll be stress testing models, validating their assumptions, and ensuring the fund doesn’t take on too much risk.

Finding opportunities: Prop trading vs. hedge funds

The two main types of firms that hire quants are proprietary trading firms and hedge funds. They might sound similar, but they have very different cultures and models.

| Feature | Proprietary Trading Firms | Hedge Funds |

|---|---|---|

| Capital Source | Firm’s own capital | External investor capital |

| Compensation | High percentage of profit-sharing | Base salary + performance bonus |

| Risk Profile | Higher individual risk, short-term focus | Diversified risk, longer-term focus |

| Culture | Autonomous and fast-paced | Collaborative and research-intensive |

Your path into algorithmic trading

Making the jump to an algorithmic trading career for CA is a marathon, not a sprint. But it’s a logical extension of the skills you already possess. Your deep-seated understanding of risk, your knack for rule-based logic, and your ability to see beyond the charts give you a unique and powerful advantage. While others may focus primarily on coding speed, your risk-first, fundamentals-aware approach is a crucial ingredient for sustainable, long-term success in the markets.

The journey requires dedication. You’ll need to master Python, get comfortable with key math concepts, build a few small projects to prove your skills, and tailor your story for the quant world. It’s a challenging path, but for the right person, it’s an incredibly rewarding one.

Ready to take the first step? Use the Resume Scorer to see how your current resume stacks up and ensure your profile is positioned for success in the competitive quant landscape.

Also read: Best AI for FP&A Tools: Features, Pros & Use Cases

Frequently Asked Questions

Q.1 Is an algorithmic trading career for CA realistic without a background in computer science?

A: Yes, it’s realistic but requires dedication. Your CA background in logic and risk management is a huge asset. The key is to bridge the gap by learning to code, specifically Python, and understanding core quantitative concepts.

Q.2 What is the most important skill to develop for an algorithmic trading career for CA?

A: While Python is the essential technical skill, your innate risk management mindset is a significant advantage. This focus on capital preservation is highly valued in the trading world and complements other approaches that may focus more on maximizing returns.

Q.3 How long does it typically take to transition into an algorithmic trading career for CA?

A: There’s no set timeline, but it’s a multi-year journey. It involves mastering new skills (Python, stats) and often includes a strategic career pivot or a master’s degree in financial engineering. It’s a marathon, not a sprint.

Q.4 Can I start building experience for an algorithmic trading career for CA while still working as a Chartered Accountant?

A: Absolutely. You can start by taking online courses in Python for finance, reading books on quantitative trading, and working on small personal trading projects. This demonstrates initiative and helps you build a portfolio to show potential employers.

Q.5 What are the typical entry-level roles for someone starting an algorithmic trading career for CA?

A: Common entry points include roles like Quantitative Analyst, Algorithmic Trading Strategist, and especially Risk Quant. A Risk Quant role is a natural fit as it directly leverages your experience with risk assessment and control frameworks.

Q.6 Do I need a Master’s in Financial Engineering (MFE) for an algorithmic trading career for CA?

A: An MFE is a very common and effective route, as it provides structured learning and networking opportunities. However, it’s not the only path. A professional pivot, where you move into increasingly quantitative roles within finance, is also a viable strategy.