Investment Banking vs Corporate Finance in India: Salary, Roles & Careers

Investment Banking vs Corporate Finance: choosing between a career is a significant decision. It is a choice that extends beyond the initial salary, shaping lifestyle, work-life balance, and long-term career prospects. In India’s competitive landscape, making an informed choice is crucial.

This guide provides a detailed breakdown of what to expect from each path, focusing on the factual differences to help you make the right decision.

Core differences

Before comparing compensation, it is important to understand the fundamental differences between the two fields. Investment banking and corporate finance can be compared to sprinting and running a marathon, respectively. Investment banking centers on advising other companies on large, high-pressure deals. Corporate finance involves managing the financial health and long-term strategy of a single company from within. As Investopedia notes, understanding this core difference is the first step toward determining the best career fit. This infographic visually breaks down the core distinctions.

Investment Banking vs Corporate Finance salary

The day-to-day responsibilities in these roles are distinctly different.

Investment banking: The sprinter approach

Investment banking operates as a series of high-intensity, project-based sprints. An investment banker acts as an external advisor, brought in to help clients execute major transactions such as mergers & acquisitions (M&A), initial public offerings (IPOs), or capital raising. The primary focus is always on closing the deal.

For a junior analyst, a typical day involves:

- Building complex financial models like Discounted Cash Flow (DCF) or Leveraged Buyout (LBO) models and performing valuations.

- Creating and repeatedly editing PowerPoint presentations, known as pitchbooks, for clients.

- Conducting in-depth due diligence and market research for potential deals, often under stringent deadlines.

- The work is fast-paced, client-facing, and driven by tight, unmovable timelines.

Corporate finance: The marathon approach

In corporate finance, the focus is on long-term strategy. Professionals act as internal strategic partners, responsible for the ongoing financial management of one company. The ultimate goal is to increase shareholder value.

Work is more cyclical and predictable, often including:

- Managing the company’s budget, creating financial forecasts, and handling Financial Planning & Analysis (FP&A).

- Overseeing the treasury function, managing cash flow, and preparing financial reports.

- Analyzing the financial viability of new internal projects, investments, or expansion plans.

- The work is internally focused and follows a rhythm dictated by monthly and quarterly business cycles.

A comparison of work-life balance

- IB: The hours in investment banking are notoriously long. It is common to work 70-100 hour weeks, particularly when a deal is active. Weekend work is often standard practice.

- CF: This career path offers a work schedule closer to a standard corporate job. Professionals typically work a more manageable 40-50 hours per week. While there are busy periods during quarter-end reporting or annual budgeting, as noted by DigitalDefynd, evenings and weekends are generally free.

A realistic look at the Investment Banking vs Corporate Finance

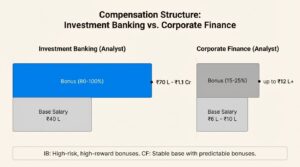

The base salary is just one part of total compensation. The bonus structure is a key differentiator and significantly impacts total earnings.

Investment banking compensation in India (INR)

In IB, the bonus is a critical component of total compensation. It is directly tied to individual and market performance and can often be 100% or more of the base salary. In strong market conditions, compensation can be exceptionally high.

Based on data from industry sources like Mergers & Inquisitions, the following is a look at expected compensation at top international (bulge-bracket) firms in India.

Table: Typical IB Compensation in India (Annual)

| Position | Base Salary (INR) | Bonus (% of Base) | Total Compensation (INR, Approx.) |

|---|---|---|---|

| Analyst (Post-IIM) | ₹40 L – ₹55 L | 80% – 100% | ₹70 L – ₹1.1 Cr |

| Associate | ₹65 L – ₹75 L | 80% – 120% | ₹1.1 Cr – ₹1.6 Cr |

| Vice President (VP) | ₹90 L – ₹1.2 Cr | 75% – 125% | ₹1.5 Cr – ₹2.7 Cr |

| Managing Director (MD) | ₹1.5 Cr+ | Highly Variable (0-300%+) | ₹1.5 Cr – ₹6 Cr+ |

Disclaimer: These numbers are for top-tier international banks. Domestic firms might offer lower base salaries but can sometimes have higher bonus percentages in very good years.

To be considered for these roles, strong technical skills are essential. Recruiters will thoroughly assess your financial modeling and valuation skills. To acquire these skills, many aspiring bankers enroll in specialized programs, such as CA Monk’s Financial Modeling & Valuation Masterclass, which focus on practical, job-oriented training.

Corporate finance compensation in India (INR)

CF salaries offer more predictability and steadier growth. Bonuses constitute a smaller, more consistent part of total pay. The path to a high salary is more gradual but can lead to very lucrative senior leadership positions.

Here is a typical career and salary progression based on data from platforms like Jaro Education.

Table: Typical CF Compensation in a Large Company (Annual)

| Position | Experience (Years) | Median Salary (INR) | High-End Salary (Top Firms, INR) |

|---|---|---|---|

| Financial Analyst | 0 – 3 | ₹6 L – ₹10 L | ₹12 L+ |

| Finance Manager | 4 – 8 | ₹14 L – ₹20 L | ₹25 L+ |

| Senior Manager / Director | 9 – 15 | ₹25 L – ₹50 L | ₹50 L – ₹1 Cr+ |

| Chief Financial Officer (CFO) | 15+ | ₹1 Cr+ | ₹1.5 Cr – ₹5 Cr+ (incl. stock options) |

While starting salaries are lower than in IB, the long-term potential is significant. A successful CFO at a large, listed Indian company is often one of the highest-paid executives, with a significant portion of their wealth derived from stock options.

Career trajectory and compensation growth

Your initial career choice significantly influences future opportunities.

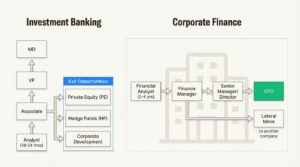

Investment banking

- Progression: The culture is known for being “up or out.” Promotions are rapid, typically occurring every 18-24 months. However, the burnout rate is high, with DigitalDefynd reporting attrition rates of over 20% at each level.

- Exit Opportunities: A key advantage of starting in IB is the wide range of exit opportunities. The intense training and deal experience open doors to some of the most coveted roles in finance. Over half of bankers who leave transition to:

- Private Equity (PE): The most common and prestigious exit.

- Hedge Funds (HF): A suitable move for those with strong analytical and market skills.

- Venture Capital (VC): Particularly for bankers who covered the technology industry.

- Corporate Development: An in-house M&A role, effectively becoming the client.

- Private Equity (PE): The most common and prestigious exit.

Corporate finance

- Progression: The career path is steadier and more predictable. Promotions typically happen every 2-4 years, and reaching a Director-level role often takes a decade or more.

- Exit Opportunities: Career paths are more focused within the corporate sector.

- Internal Leadership: The most common goal. Approximately 40% of CF professionals aim to climb the ladder to become a Finance Director or CFO within their company.

- Lateral Moves: Moving to a similar or senior role at another company, often for a salary increase or a better title.

- Switching from corporate finance to investment banking is challenging. As Investopedia points out, most CF roles do not provide the intense, deal-focused modeling experience that IB recruiters seek. For those serious about making such a switch, the resume must clearly demonstrate deal-related experience. A useful step is to analyze your resume with a tool like a Resume Scorer to ensure it uses appropriate language to pass initial screenings.

- Internal Leadership: The most common goal. Approximately 40% of CF professionals aim to climb the ladder to become a Finance Director or CFO within their company.

Key industry considerations

Here are some practical considerations based on industry realities.

- Front-office IB roles in India are highly competitive and limited in number. There are likely fewer than 100 front-office analyst roles available across all top banks in India each year, a fact noted by Mergers & Inquisitions. The competition is extremely high, and most of these banks recruit almost exclusively from top IIMs. It is important to distinguish these from “KPO” or back-office support roles, which are a different career path.

- Personality fit is as important as technical skill. Even technically skilled professionals can struggle in IB if the high-pressure culture does not align with their personality. Conversely, many CAs thrive in corporate finance, enjoying the collaborative environment and strategic focus. It is important to self-assess whether you are better suited for a high-adrenaline, deal-driven environment or a more stable, strategic role.

- Corporate finance is a distinct and valuable career path. Roles in FP&A or Treasury require deep, specialized skills and offer a clear path to significant influence and compensation. To excel in this field, mastering practical skills is essential. This is why programs like CA Monk’s FP&A Masterclass are popular among CAs targeting these high-growth corporate roles.

- Your first job sets a strong career direction. While career pivots are possible, they become more difficult with seniority. It is crucial to start building the skills for your desired long-term career now. If you are in audit but aim for IB or a top-tier FP&A role, you must proactively demonstrate skills beyond traditional audit work.

Making a choice

Ultimately, there is no single “better” path. The optimal choice depends on an individual’s personality, risk tolerance, and long-term career goals.

- Choose Investment Banking if: You are pursuing high short-term compensation, desire the most prestigious exit opportunities in finance, and thrive in a high-pressure, demanding environment.

- Choose Corporate Finance if: You value work-life balance, prefer stable and predictable career growth, and are motivated by becoming a deep industry expert and a strategic leader within a single company.

Regardless of the chosen path, thorough preparation is critical. Practice technical concepts and interview responses extensively. Using tools like an Interview Bot can help build the confidence needed for high-stakes interviews.

Also read: Transfer Pricing Career Guide: Global Roles & Salaries