Top 7 R2R Interview Questions for 2026 (& How to Lead an Sap FICO Career)

After clearing your CA or CMA exams, the next step is determining your career path. You may receive advice suggesting you avoid shared services roles like Record to Report (R2R), which are sometimes perceived as having limited growth opportunities.

However, this perspective may overlook a significant opportunity. An R2R role can serve as a strategic entry point to a high-paying, in-demand career as an SAP FICO consultant.

R2R involves more than closing the books; it provides practical, hands-on experience with the real-world business processes managed by systems like SAP. This guide is designed to help you prepare for the interview for this crucial first step. We will break down the most common R2R interview questions and provide expert answers to demonstrate your understanding of accounting within a large-scale global system.

What is the R2R process?

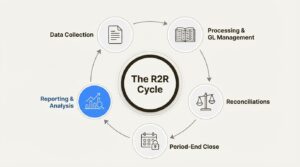

The Record to Report (or R2R) process is the end-to-end method companies use to collect, process, and generate financial statements. It provides a comprehensive view of a company’s financial health for a specific period, from individual transactions to the final annual report. This process gives decision-makers an accurate picture of the company’s performance.

The process includes several core components:

- Gathering and processing raw financial data.

- Managing the general ledger.

- Performing reconciliations to ensure accuracy.

- Executing the period-end close.

- Creating reports for leadership decision-making.

This workflow is fundamental to a company’s financial management. It is a central component of large Enterprise Resource Planning (ERP) systems like SAP S/4HANA, which are designed to streamline and improve the accuracy of this process.

R2R as a gateway to a SAP FICO career

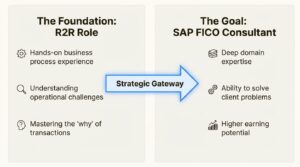

Many new graduates view R2R and SAP FICO as two separate career paths. In reality, they are closely linked. SAP FICO (Finance and Controlling) is the complex tool, and R2R is the real-world business process that the tool is designed to manage.

To become an effective SAP consultant, a deep understanding of the business problems is essential. An R2R role provides this understanding. It offers daily, hands-on experience with the process, allowing you to see operational challenges and the importance of controls. This practical knowledge is highly valued by employers, often more so than certification alone.

Working in R2R, especially at a company using SAP S/4HANA, puts you on the front lines of modern finance. You’ll be working with innovations like the Universal Journal, which is SAP’s way of creating a single source of truth for all financial and controlling data.

After 2-3 years of mastering the why behind the transactions, you become an incredibly strong candidate for a consulting role. Companies hiring SAP FICO consultants highly value individuals with strong domain expertise. They need consultants who can understand and address a client’s specific finance-related challenges.

How we selected R2R interview questions

These questions were selected because they are frequently asked in interviews at leading companies and Big 4 firms. They effectively assess a candidate’s suitability for the role. The selection was based on the following criteria:

- Frequency: These are the questions you’re almost guaranteed to face for any R2R role. They’re the fundamentals.

- Conceptual Depth: They test if you actually get the core accounting principles, not just if you’ve memorized a few definitions.

- Practical Application: The questions are directly linked to the day-to-day tasks you’ll do in the job and how they’re handled inside an ERP system like SAP.

- Career Progression: Answering these well shows you have the analytical and problem-solving skills to grow beyond an entry-level role and into a more senior or consulting position.

Top R2R Interview Questions Comparison

The following table provides a summary of how these questions connect to core concepts and specific tools within SAP. This framework can help structure your preparation.

| Question Category | Key Concepts Tested | Typical Experience Level | Relevant SAP T-Codes/Apps |

|---|---|---|---|

| Process Overview | End-to-end R2R cycle, GL management | Fresher | FB01, F-02, FS00 |

| Month-End Activities | Period closing, accruals, reconciliations | Fresher / Intermediate | F.13, F.19, OB52 |

| Intercompany Accounting | Group consolidation, elimination entries | Intermediate | FBU3, FBICIMG3 |

| ERP Systems | SAP S/4HANA proficiency, T-Codes, Fiori Apps | All Levels | FB50, FBL3N, FAGLL03 |

| Core Accounting | Accrual vs. Deferral, Matching Principle | Fresher | FBS1, F.81 |

| Analytical Skills | Variance analysis, root cause analysis | Intermediate / Experienced | S_ALR_87013611, FAGLL03 |

| Problem Solving | Error identification, internal controls, AIF | All Levels | /AIF/ERR |

The top 7 R2R interview questions (2026)

Below are the top seven questions you need to be ready for, along with guidance on how to answer them effectively.

1. What are the key components of the Record to Report process?

- Why interviewers ask this: They are checking if you see the big picture. They want to know if you can visualize the entire financial reporting lifecycle from start to finish, not just one small piece of it.

- How to answer: Instead of just listing a few steps, walk them through the journey of a single dollar. Outline the main phases: data collection, processing journal entries, managing the general ledger, reconciling sub-ledgers (like Accounts Payable and Accounts Receivable), executing the period-end close, consolidating results from different entities, and finally, reporting and analysis.

- Example answer: “The R2R process is the full journey from recording individual financial transactions to generating the final financial statements for management and stakeholders. It kicks off with collecting raw data and posting journal entries. From there, it involves managing the general ledger, reconciling all the sub-ledgers, and then moving into the critical month-end closing activities. Once the books are closed, we handle consolidation if there are multiple legal entities, and finally, we produce the key reports like the P&L and Balance Sheet for analysis. In an SAP environment, this entire flow is managed within the FI and CO modules, with transactions ultimately feeding into a single source of truth, the Universal Journal in S/4HANA.”

2. Explain the month-end closing process and your specific role in it.

- Why interviewers ask this: This is where theory stops and reality kicks in. They want to gauge your practical experience, your ability to handle tight deadlines, and your understanding of how critical this process is for accurate reporting.

- How to answer: Be specific and use real examples if you have them. Talk about the exact tasks you were responsible for, like posting accrual and deferral documents, reconciling bank accounts, running depreciation, or clearing key accounts. If you have a good story, use the STAR method (Situation, Task, Action, Result) to make it stick.

- Example answer: “In my previous internship, my role during the month-end close was focused on two key areas: GR/IR clearing and bank reconciliations. I was responsible for using transaction code F.13 for the automatic clearing of the Goods Receipt/Invoice Receipt accounts to ensure we weren’t overstating liabilities. I also used F.19 for GR/IR reclassification at month-end. This made sure that any goods received but not yet invoiced were correctly accrued for, aligning our costs and liabilities for the period.”

3. How do you handle intercompany reconciliations?

- Why interviewers ask this: Intercompany accounting is famously messy. Transactions between two entities in the same corporate group are a common source of errors during financial consolidation. This question tests your attention to detail and your communication skills.

- How to answer: Describe the methodical process you would follow. It’s all about matching transactions, identifying the mismatches, and then fixing them. Talk about running reports, communicating with your counterparts in the other company, and figuring out why things don’t line up.

- Example answer: “My approach to intercompany reconciliations starts with identifying all the intercompany transactions for the period, which I’d do using reports or a transaction code like FBU3 to display the relevant documents. The next, and most important, step is to communicate with my counterparts in the other entity. We’d compare our records and work together to resolve any discrepancies, which are usually due to timing differences, foreign exchange rates, or transfer pricing issues. Once everything matches, the necessary elimination entries can be posted for a clean consolidation.”

4. What is the difference between accruals and provisions?

- Why interviewers ask this: This is a classic accounting principles question. It’s a quick way for them to tell if you truly understand the concepts or if you’ve just memorized definitions. Getting this right shows you have a solid foundation.

- How to answer: Define both terms clearly and simply, then give a practical example for each. The key difference is the level of certainty. An accrual is for something you know you owe, while a provision is for something you probably owe.

- Example answer: “They both represent obligations, but the main difference is the level of certainty. An accrual is a liability for goods or services that have been received but not yet invoiced, so the amount is usually known and certain. A great example is electricity used in December that won’t be billed until January. A provision, on the other hand, is a liability where the timing or the exact amount is uncertain, but it’s still probable. For example, a provision for warranty claims on products sold, where you have to estimate the future cost based on historical data.”

5. How do you approach variance analysis?

- Why interviewers ask this: This question tests your skills beyond just processing data. They want to see if you’re an analyst who can interpret what the numbers are telling you. It’s about finding the story behind the data.

- How to answer: Describe your methodology. You don’t just stare at the numbers; you have a process. Explain how you start at a high level (like budget vs. actual on the P&L) to spot the big differences, and then you drill down to the line-item level to investigate the root cause.

- Example answer: “My approach to variance analysis is top-down. When I see a significant variance in a P&L line item, my first step isn’t to guess; it’s to get the details. I’d run a general ledger line item report using a transaction like FAGLL03 to see every single posting that makes up that total. This lets me analyze the transaction details, like posting text, user IDs, and amounts, to understand what drove the variance. For a broader view, like analyzing costs for a specific department, I might use a cost center report like S_ALR_87013611 to compare actual spending against the plan.”

6. What ERP systems have you worked with, and which SAP modules are you familiar with?

- Why interviewers ask this: This is a direct question to gauge your technical skills. They want to know how much training you’ll need and how quickly you can start contributing to their team in their specific system.

- How to answer: Be honest and specific. Name the systems you’ve used (like SAP S/4HANA or SAP ERP). From an R2R perspective, you’ll want to mention the core modules you’ve touched: definitely FI (General Ledger, AP, AR) and probably some CO (Controlling) for pulling reports.

- Example answer: “I have over two years of hands-on experience working daily in SAP S/4HANA, primarily within the FI module. I’m very comfortable with the T-codes for day-to-day R2R tasks, like posting journal entries with FB50, viewing vendor and customer line items with FBL1N and FBL5N, and running trial balances. I’m also familiar with how the FI module integrates with other key areas like Sales and Distribution (SD) and Materials Management (MM), as that’s where many of our transactions originated.”

7. Describe a time you identified and corrected a significant error during the closing process.

- Why interviewers ask this: This is a classic behavioral question. They want to assess your problem-solving skills, your attention to detail under pressure, and your integrity. They want to know if you’re the kind of person who will flag an issue or just ignore it.

- How to answer: The STAR method (Situation, Task, Action, Result) is highly effective for this type of question. Tell a concise story. Situation: Set the scene (e.g., “It was the second day of a tight month-end close…”). Task: Explain your responsibility. Action: Detail the steps you took. This is a great place to mention specific reports or T-codes you used to investigate (like FAGLL03 to trace a document). Result: Explain the positive outcome—the financials were corrected, and maybe you even helped implement a new control to prevent it from happening again.

- Example answer: “During one month-end close, I was reconciling a major expense account and noticed it was almost 50% over budget, which was highly unusual. My task was to figure out why before we closed the books. I used T-code FAGLL03 to drill down into the line items and found one very large invoice that had been miscoded to our department instead of another. I traced it back to the original invoice, confirmed the coding error with the AP team, and worked with my manager to post a correcting journal entry with all the proper documentation attached for the audit trail. As a result, our department’s financials were accurate, and we avoided some very awkward questions from management.”

From R2R to SAP FICO Consultant

As demonstrated, these questions are not just about bookkeeping. They are about understanding the core financial processes that make a business run. Mastering these concepts in a hands-on role is excellent preparation for a future in ERP consulting.

An R2R role teaches you the “why” behind every transaction and report. This business context is exactly what purely technical consultants often lack, and it is what can make you a valuable asset on any implementation project. Think of your R2R interview not as an interview for a “BPO job,” but as the first official step on your path toward a highly rewarding career in the SAP ecosystem.

Is your resume ready?

Strong interview answers are crucial, but a well-crafted resume is the first step to securing an interview. R2R roles at companies using SAP are competitive, and your resume first needs to get past the automated screening tools (ATS) that filter out most applications.

Does your resume highlight the right Accounting Standards and specific SAP T-codes that recruiters are looking for? Find out instantly with our Resume Scorer. Get an instant analysis and actionable feedback to make sure your resume stands out and lands on the hiring manager’s desk.