Investment Banking vs. Statutory Audit: Salary & Growth Reality Check

Congratulations on clearing your CA exams. After completing a demanding curriculum, you are now at a classic fork in the road and deciding what comes next. For many new CAs, that choice boils down to two prominent fields: Investment Banking (IB) and Statutory Audit.

On one side is investment banking, a field focused on high-value transactions, complex valuations, and significant performance-based bonuses. On the other side is statutory audit, a compliance-focused path that forms a critical part of the financial ecosystem, where professionals verify financial information.

How do you choose between them? This decision is about more than a job; it’s about selecting a lifestyle, a skillset, and a long-term career trajectory. This article provides a direct comparison of salaries, work-life balance, and potential career paths to help inform your choice.

Salary: Investment Banking vs. Statutory Audit

Let’s get right to it. For most of us, salary is a huge piece of the puzzle. At first glance, investment banking compensation appears much higher, but the figures require context.

There’s a running sentiment in the audit world that “we make the same as IB analysts on a per-hour basis.” While this is often said in jest, it highlights an important point. IB roles require a significant number of hours, which impacts the effective hourly wage. However, the total compensation gap is significant.

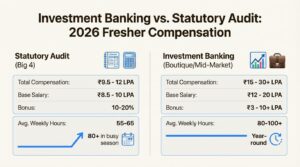

Here’s what you can expect as a CA fresher in 2026:

| Metric | Statutory Audit (Big 4) | Investment Banking (Boutique/Mid-Market) |

|---|---|---|

| Typical Role | Audit Associate | M&A / Valuations Analyst |

| Base Salary (2026) | ₹8.5 – 10 LPA | ₹12 – 20 LPA |

| Est. Bonus (2026) | 10-20% of base | ₹3 – 10+ LPA (deal-dependent) |

| Total Compensation | ₹9.5 – 12 LPA | ₹15 – 30+ LPA |

| Avg. Weekly Hours | 55-65 (80+ in busy season) | 80-100+ (Year-round) |

Looking at the table, the difference is clear. In a Big 4 audit role, you’re looking at a competitive package of around ₹9.5 to 12 lakhs per year. In deal advisory teams, that might go up to the ₹11-12 LPA range, which is a good start.

IB base salaries, even at smaller firms, are often higher than the total pay in audit. Landing a spot at a top global bank like Goldman Sachs could mean ₹20 LPA or more. The most significant variable is the bonus. In a good year with plenty of deals, an analyst’s bonus can be substantial, sometimes exceeding an audit associate’s total annual salary. This high-risk, high-reward structure is a key financial appeal of investment banking, as compensation is directly tied to deal performance.

Work-life Balance

If salary is the first question, work-life balance is a very close second. Both fields are demanding, but in different ways. Individual work style and resilience are important factors in this decision.

Statutory audit: The predictable sprint

In audit, your work life revolves around the “busy season.” These are intense periods, usually around quarterly and annual reporting deadlines, filled with checklists, client calls, and late nights. Working 80-plus hours a week isn’t out of the ordinary during these times.

The key difference is its predictability. You know when the busy season is coming, you can prepare for it, and you know it will end. After this period, the workload typically decreases to a more standard 50-60 hour week, allowing for better personal planning. It’s a cycle of intense work followed by periods of relative calm.

Investment banking: The unpredictable marathon

Investment banking is a different experience. The workload is driven by deal flow rather than cyclical deadlines. A new M&A project, a last-minute client request for a presentation, or a massive valuation project can land on your desk at 5 p.m. on a Friday, eliminating your weekend plans. People who’ve worked in both fields agree that the IB busy season is basically “YEAR-ROUND.”

The culture is “always on call,” and you are expected to be available 24/7. This constant unpredictability is what burns so many people out. The challenge is not only the long hours but also the inability to plan personal time. That dinner with friends might be canceled. That trip you booked may involve taking calls from the hotel lobby. It is a continuous high-intensity environment with no defined off-season.

Accounting Standards vs. Financial Modeling

While both roles require strong analytical skills and quantitative aptitude, the technical skills you build are completely different. Your CA training provides a great start, but how you apply that knowledge diverges from day one.

Statutory audit: Mastering accounting standards

The audit path develops expertise in accounting principles. You’ll get a deep, hands-on understanding of accounting standards like Ind AS and IFRS, audit methods, and the complex system of internal controls that keeps a company on track.

The primary focus is retrospective. Auditors act as financial detectives, ensuring that financial statements present a “true and fair” view of past performance. You learn to verify the accuracy and compliance of financial data. This skillset is foundational for financial roles in large corporations.

Investment banking: Mastering financial modeling

Investment banking, on the other hand, is primarily forward-looking. The role involves building complex financial models to project a company’s future value. Your primary tools are valuation techniques, not just accounting standards. You will work extensively with methods like Discounted Cash Flow (DCF), leveraged buyout (LBO) models, and merger & acquisition (M&A) models.

The main skill here is strategic financial analysis. You’re not just reporting numbers; you’re using them to answer big questions about a company’s future, such as the implications of buying a competitor, a fair price for a startup, or how much capital to raise.

This presents a challenge for many CAs. While the CA curriculum provides an excellent foundation in accounting theory, it often does not cover the practical, intensive financial modeling required from day one in an IB role. As recruiters will tell you, CAs need to know financial modeling before the interview. It’s a major skill gap to fill on your own to be considered.

Audit trains you for financial discipline. To get into IB, you need to speak the language of valuation. Our Financial Modeling Course is designed by industry experts to teach you exactly that.

Career Growth

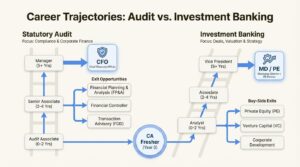

Where you start has a significant impact on where you can end up. Thinking about your career in 3-5 years is just as important as your first-year salary. For many, spending 2-3 years in a role is the best time to make a move and leverage your experience.

The statutory audit path

In audit, the career path is clear, structured, and well-respected. You move up a defined ladder: Audit Associate, Senior Associate, Manager, Senior Manager, and, potentially, Partner. It’s a long-term progression, with each level building on the one before it.

A significant advantage of a Big 4 audit background is the range of exit opportunities. After 2-3 years, you become a strong candidate for various corporate finance jobs. Common moves include:

- Financial Planning & Analysis (FP&A): You move from reviewing past results to helping the business plan for the future, working on budgets, forecasts, and strategic plans.

- Financial Controller: You become responsible for managing a company’s accounting. It’s a direct path to a senior leadership role, often working closely with the CFO.

- Internal Audit: You work inside a single company to improve its processes and controls, similar to an in-house consultant.

- Transaction Advisory Services (TAS/FDD): This is a popular move for auditors who want to get closer to the world of deals. You’ll work on financial due diligence for M&A deals, which can open doors to IB later on.

Ultimately, the audit path is often considered a traditional training ground for future CFOs and leaders in corporate finance.

The investment banking path

The IB career track is equally structured but more competitive. The progression goes from Analyst to Associate, then to Vice President (VP), and finally Managing Director (MD). It’s known for its “up or out” culture, where you either get promoted on time or you’re encouraged to move on.

Investment banking is often seen less as a lifelong career and more as a two-year training program for other high-level finance roles. After finishing the demanding analyst program, the most popular exit opportunities are on the “buy-side”:

- Private Equity (PE): This is a common goal for many IB analysts. You go from advising on deals to actually buying and running companies yourself. It’s one of the most popular exits from banking.

- Venture Capital (VC): Instead of buying established companies, you invest in promising new start-ups.

- Hedge Funds: You move into the world of public markets, creating complex investment strategies to generate high returns.

- Corporate Development: You join a large company’s internal M&A team, helping them acquire other companies to grow.

This path suits individuals who are motivated by deal-making and aim for top-tier roles in the finance industry.

Making the right choice

Ultimately, there is no single “better” path. The ideal choice depends on your personal and professional goals.

Statutory Audit gives you an excellent foundation, a more predictable (though still demanding) lifestyle, and a clear, respected path to becoming a leader in corporate finance. It’s the right choice for those who value stability, deep technical knowledge, and want to build a career as a key leader inside a company. It’s the CFO track.

Investment Banking offers a path into high finance. The compensation is higher, the work environment is fast-paced, and it serves as a direct launchpad to other prominent roles in the industry. However, this path involves long hours, high pressure, and a demanding lifestyle. It is a high-stakes, high-reward career.

Consider your personality, long-term goals, and tolerance for intensity. The right answer is the one that aligns with your individual priorities.

Our Statutory Audit Masterclass is designed to bridge the gap between theory and practice. Gain hands-on, industry-aligned audit skills, work on real projects, and build the precision and risk expertise top firms look for. Enroll today and step into core finance roles with confidence.

Also read: Power BI vs. Tableau: Which tool is better for CAs?